Entrepreneurs

Why Howard Schultz Is So Successful

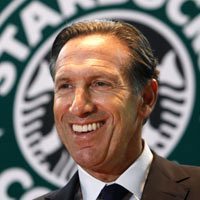

Howard Schultz is the American chairman and CEO of Starbucks. Although Schultz is most famous for his Coffee business, he was also the former owner of the Seattle SuperSonics and was on the board of directors at Square Inc.

Early Career

Schultz graduated from Northern Michigan University with a Bachelor’s Degree in Communication and proceeded to gain employment as a Salesman, selling appliances for Hammerplast who sold European Coffee makers across the USA. In five years, Schultz had climbed the ladder to become director of sales and he observed that he was selling the most coffee makers to a small coffee business in Seattle, known at the time as Starbucks Coffee Tea and Spice Company. He was selling more to these few stores than he was to Macy’s.

Schultz graduated from Northern Michigan University with a Bachelor’s Degree in Communication and proceeded to gain employment as a Salesman, selling appliances for Hammerplast who sold European Coffee makers across the USA. In five years, Schultz had climbed the ladder to become director of sales and he observed that he was selling the most coffee makers to a small coffee business in Seattle, known at the time as Starbucks Coffee Tea and Spice Company. He was selling more to these few stores than he was to Macy’s.

Schultz knew he had to go to Seattle when the increase in numbers never stopped. He was selling more and more coffee makers to them every month. Schultz still fondly remembers the first time that he walked into the original Starbucks and at the time it was only 10 years old and only existed in Seattle.

Howard Schultz’s net worth is an estimated $2.6 Billion

Howard Schultz and modern Starbucks

In 1982, one year after meeting with the founders of the original Starbucks, Schultz took the position of director of retail operations and marketing for the rapidly growing coffee business. At this time, they were only selling coffee beans and not coffee to drink. Zev Siegl, one of Starbucks’ co-founders highlighted Shultz’s “fabulous communication skills” as a major strength.

In 1982, one year after meeting with the founders of the original Starbucks, Schultz took the position of director of retail operations and marketing for the rapidly growing coffee business. At this time, they were only selling coffee beans and not coffee to drink. Zev Siegl, one of Starbucks’ co-founders highlighted Shultz’s “fabulous communication skills” as a major strength.

Schultz was determined to have a big impact on the company from day one and made Starbucks’ mission his own. It was whilst travelling Italy in 1983 that an important idea struck him. He realised that Starbucks should not just sell coffee beans but sell coffee drinks as well. He recalls that it wasn’t just the romantic idea of coffee, it was the sense of community and the connection between the people, the coffee and one another. He couldn’t wait to get back to Seattle and describe how he had “seen the future”.

“I think if you’re an entrepreneur, you’ve got to dream big and then dream bigger.” – Howard Schultz

The company’s founders did not have the same enthusiasm for opening coffee bars within Starbucks’ stores and they insisted that it wasn’t for them. However, Schulz was persistent until the owners finally allowed him to open a coffee bar in a new store that was due to open in Seattle. It was an immediate success and it was attracting hundreds and hundreds of customers per day.

The company’s founders did not have the same enthusiasm for opening coffee bars within Starbucks’ stores and they insisted that it wasn’t for them. However, Schulz was persistent until the owners finally allowed him to open a coffee bar in a new store that was due to open in Seattle. It was an immediate success and it was attracting hundreds and hundreds of customers per day.

However, the rapid success of the coffee bar confirmed to the owners that they didn’t want to go in the same direction as Schultz and they didn’t want to get too big. A disappointed Schultz left Starbucks in 1985 to open a chain of coffee bars on his own, called Il Giornale and it quickly became successful.

“At an early age, my mother gave me this feeling that anything is possible, and I believe that.” – Howard Schultz

A couple of years later, Schultz was able to purchase Starbucks with the help of investors and merged Il Giornale with his former employers. He then became CEO and chairman of Starbucks, which was to be known as the Starbucks Coffee Company. Schultz had to use all of communication skills to bring investors around to the idea that Americans would pay high prices for a drink they were used to getting for 50 cents. At that time, most people weren’t aware of the differences between high quality coffee and the instant varieties, this was on top of the fact that coffee consumption was on the decline in the USA.

Schultz publicly resigned as Starbucks’ CEO in 2000, however, he returned as the company’s boss in 2008 and in 2009 he famously said, when describing Starbucks’ mission; “We’re not in the business of filling bellies; we’re in the business of filling souls.”

The Continued Success of the Starbucks Coffee Company

The growth of Starbucks has allowed Schultz to be ranked in Forbes magazine’s “Forbes 400” list, which highlights the 400 richest people in the USA.

The growth of Starbucks has allowed Schultz to be ranked in Forbes magazine’s “Forbes 400” list, which highlights the 400 richest people in the USA.

There is no single company is selling more coffee to more people in more places than Starbucks. The company had expanded to include more than 17,600 stores in 39 countries all across the globe by 2012. By 2014, Starbucks had surpassed 21,000 stores with new stores reportedly opening every single day and the company now attracts in excess of 60 million customers per week.

Howard Schultz: 6 Habits of True Strategic Thinkers

Conclusion

Howard Schultz has combined incredible communication skills, persistence, strategic thinking and a clear vision to impact hundreds of millions of people’s lives and make himself a billionaire in the process.

Schultz’s story teaches us that although others may not share our vision, we have to remain true to what we believe is possible and pursue that vision anyway.

Entrepreneurs

How Business Owners Can Keep Their Employees Motivated Daily

Employees who look forward to coming into the office will always perform better

We all know that it can be difficult to maintain our professional momentum when the going gets tough. However, motivated employees will always rise to the occasion. (more…)

Entrepreneurs

How Entrepreneurs Are Retaining Top Talent

Onboarding is not just a procedural formality; it’s a strategic opportunity to set the stage for long-term employee retention

You’ve just hired a promising new employee. They’re eager, full of potential, and ready to dive in. But how do you ensure they stay with your company for the long haul? The answer lies in a robust on-boarding process.

Let’s explore why on-boarding is crucial for employee retention and how it can benefit your business and personal development. (more…)

Entrepreneurs

How to Regain Your Confidence After Falling Prey to a Scam

Online scams are constantly changing. However, you can stay ahead of the game by remaining informed and vigilant.

Scams, both online and offline, are painful experiences when you trust someone, and they use it against you. Remember, it’s not your fault. It could have happened to anyone. Even to the most cautious individuals, especially since you can get scammed online in many ways. These situations happen to a lot of people and don’t reflect your naivety but rather your good-willed nature. (more…)

Entrepreneurs

Top 12 Books Every Young Entrepreneur Should Read

The following books were conceptualized, written, and published by successful entrepreneurs who have walked down the road you intend to follow.

If you’re a young entrepreneur, it’s easy to get lured by the drive to execute your ambitions as soon as possible. However, before jumping in, it’s crucial to amass the proper knowledge to ensure you have all the tools you need to succeed. (more…)

-

Life4 weeks ago

Life4 weeks agoHow to Have the Audacity to Pursue Your Greatest Potential

-

Success Advice4 weeks ago

Success Advice4 weeks agoHow to Master Your Money and Build a Better Future

-

Life3 weeks ago

Life3 weeks agoOverworked and Stressed? This Can Save Your Sanity

-

Life3 weeks ago

Life3 weeks agoIf You Have This Attachment Style It’s Killing Your Success

-

Success Advice3 weeks ago

Success Advice3 weeks agoLeadership Lessons All Future Leaders Need to Know

-

Success Advice2 weeks ago

Success Advice2 weeks ago6 Powerful Tips to Supercharge Your Small Online Business

-

Entrepreneurs2 weeks ago

Entrepreneurs2 weeks agoHow Entrepreneurs Are Retaining Top Talent

-

Success Advice2 weeks ago

Success Advice2 weeks agoHow to Build Character That Guarantees Lasting Success

1 Comment