Entrepreneurs

Why Richard Branson Is So Successful

Sir Richard Branson is a businessman investor from the UK. He is the founder of the Virgin Group which is made up of more than four hundred companies.

Branson famously left school at sixteen and began his entrepreneurial journey immediately when he started a magazine and quickly branched out into the record business..

Branson now heads a globally recognised brand, fuels global humanitarian efforts and is famous for his adventurous spirit.

The Early Days

After being challenged for many years by his dyslexia, Richard Branson decided to leave school at sixteen to start a youth culture magazine called Student. The idea was it was to be a magazine run by students for students and Branson sold the first fifty thousand copies for free after covering costs by selling over $8,000 worth of advertising.

After being challenged for many years by his dyslexia, Richard Branson decided to leave school at sixteen to start a youth culture magazine called Student. The idea was it was to be a magazine run by students for students and Branson sold the first fifty thousand copies for free after covering costs by selling over $8,000 worth of advertising.

At the age of nineteen, Branson was living in a London commune and was in close contact with the music and drug scene. It was whilst in this environment that he had the idea of starting a mail-order record company called Virgin to help fund his magazine. The company did well enough for Branson to expand his business by adding a record shop in the famous Oxford Street, London. After the record company began to do well, the boy who dropped out of school was able to build his first recording studio.

Virgin Records

Branson and Virgin Record’s first recording was the smash hit ‘Tubular Bells’ by Mike Oldfield. The song stayed in the UK charts for two hundred and forty seven weeks. Eager to rapidly build on the success, Branson signed other up and coming groups to his label, including the Sex Pistols. Virgin Records then grew to one of the biggest record companies in the world as Branson proceeded to sign Genesis, Culture Club and The Rolling Stones.

“Do not be embarrassed by your failures, learn from them and start again.” – Richard Branson

The Growth of an Empire

Branson continued to increase his entrepreneurial efforts, including the travel company Voyager Group in 1980 and the birth of the airline Virgin Atlantic in 1984, as well as a series of Virgin Megastores. However, his journey was not without some adversity and in 1992 Virgin found itself struggling to function financially and Virgin Records was sold that same year to EMI for $1 Billion. Branson was deeply hurt by having to sell the record business where it all started and he apparently cried when the sale was finalized. He was adamant that he was going to stay in the music business and he founded Virgin Radio in 1993 and started a second record company, V2 in 1996.

Branson continued to increase his entrepreneurial efforts, including the travel company Voyager Group in 1980 and the birth of the airline Virgin Atlantic in 1984, as well as a series of Virgin Megastores. However, his journey was not without some adversity and in 1992 Virgin found itself struggling to function financially and Virgin Records was sold that same year to EMI for $1 Billion. Branson was deeply hurt by having to sell the record business where it all started and he apparently cried when the sale was finalized. He was adamant that he was going to stay in the music business and he founded Virgin Radio in 1993 and started a second record company, V2 in 1996.

Branson’s Virgin Group has grown to hold more than 400 companies across the globe with business activity in the UK, the USA, Australia, Canada, Asia, South Africa and mainland Europe. The Virgin Group and Branson have expanded into trains, mobile phones, TV, drinks, banks and more.

Richard Branson’s estimated net worth is $4.7 Billion.

Virgin Galactic

Recently, the ambitious and adventurous Richard Branson has dedicated a large portion of his time and energy to his space tourism project. In the autumn of 2000, Branson announced that Virgin Galactic will license the technology behind Spaceship One funded by the co-founder of Microsoft, Paul Allen and designed by the renowned aeronautical engineer from the USA, Burt Rutan. The vision is to take paying passengers into space at a cost of $200,000. By 2014 over five hundred people had purchased tickets to go on one of Virgin Galactic’s Voyages.

Humanitarian Efforts

Towards the end of the 1990’s, Branson and musician Peter Gabriel met with Nelson Mandela to discuss their idea of a group of leaders with no personal agenda, working together to tackle global conflicts. In the summer of 2007, Mandela announced the formation of an independently funded group of donors ‘The Elders’ who were to use their skills to find peaceful resolutions to conflicts. They would also create new approaches to global challenges that were causing or may cause human suffering. In 1999, Branson became the founding sponsor of the International Centre for Missing & Exploited Children. The organizations goal is to locate missing children and put an end to the exploitation of young people.

Towards the end of the 1990’s, Branson and musician Peter Gabriel met with Nelson Mandela to discuss their idea of a group of leaders with no personal agenda, working together to tackle global conflicts. In the summer of 2007, Mandela announced the formation of an independently funded group of donors ‘The Elders’ who were to use their skills to find peaceful resolutions to conflicts. They would also create new approaches to global challenges that were causing or may cause human suffering. In 1999, Branson became the founding sponsor of the International Centre for Missing & Exploited Children. The organizations goal is to locate missing children and put an end to the exploitation of young people.

“My philosophy is that if I have any money I invest it in new ventures and not have it sitting around.” – Richard Branson

In 2008 Branson was the host of a gathering designed to discuss global warming related problems that face the world with the view of it being the first of many meetings. Branson held the meeting on his private island in the British Virgin Islands and British Prime Minister Tony Blair, Wikipedia founder Jimmy Wales and Google’s Larry Page were all present.

In 2008 Branson was the host of a gathering designed to discuss global warming related problems that face the world with the view of it being the first of many meetings. Branson held the meeting on his private island in the British Virgin Islands and British Prime Minister Tony Blair, Wikipedia founder Jimmy Wales and Google’s Larry Page were all present.

Late 2013, Branson urged businesses to boycott Uganda because of the bill it had passed against homosexuality. Branson stated that it would be against his conscience to support the country and that governments had to realize that people should be free to love who they want.

Conclusion

Richard Branson has made himself a billionaire whilst enriching the lives of other through business and humanitarian work. His ability to take things that already exist and do them better is incredible as well his ability to keep creating business ideas whilst not being deterred by ‘failures’.

As people that are looking to be successful in life we can truly learn from Richard Branson’s philosophy of embracing ‘failures’ and learning from them to ultimately achieve great things.

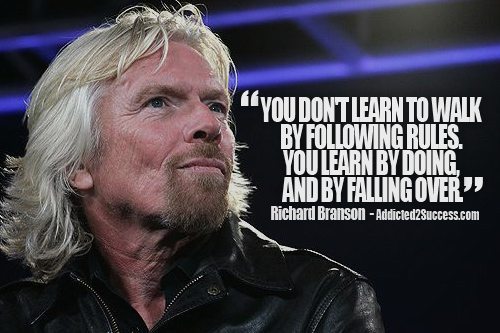

Richard Branson Picture Quote

Entrepreneurs

Why Passion, Not Profit, Builds the Most Successful Businesses

While the dream is grand, the journey comes with real challenges, risks, uncertainty, and setbacks that test your resilience

Entrepreneurship excites many. The idea of being your own boss, building something meaningful, and breaking free from the 9-to-5 grind is incredibly appealing. (more…)

Entrepreneurs

Why Most Successful Entrepreneurs Feel Like Imposters and How to Fix It

Signs and symptoms of imposter syndrome

Among all the open discourse on mental illness and how it affects different people in their lives, you may have occasionally heard the phrase “Imposter Syndrome” from time to time. (more…)

Entrepreneurs

Smart Business Owners Are Using These Natural Hacks to Outperform the Competition

The smartest companies have figured out that naturopathy in the workplace isn’t just feel-good fluff

Ever sat at your desk thinking, “I seriously can’t handle another day of this”? Does your neck ache because your chair feels more like a torture device than office furniture? Or maybe you’ve been waking up at night panicking about that dreaded meeting again. (more…)

Entrepreneurs

This Scientific Tool Is Reshaping the Way We Make Business Decisions

Organisations that integrate technology intelligently see transformation not just in output, but in thinking

The rules have changed. Technology no longer plays a supporting role, it now drives progress across every industry. From laboratories to boardrooms, innovation has become essential. (more…)

-

Did You Know4 weeks ago

Did You Know4 weeks ago7 Surprising Life Lessons Video Games Taught Me That School Never Did

-

Success Advice4 weeks ago

Success Advice4 weeks agoHow Playing by the Rules Became the Smartest Business Strategy

-

Success Advice4 weeks ago

Success Advice4 weeks agoHow to Build Trust, Kill Micromanagement, and Lead a Team That Thrives

-

Success Advice3 weeks ago

Success Advice3 weeks agoSuccess Isn’t Sexy: 5 Daily Habits That Actually Work

-

Scale Your Business3 weeks ago

Scale Your Business3 weeks agoHow to Build a Workplace People Actually Want to Show Up To

-

Scale Your Business3 weeks ago

Scale Your Business3 weeks agoHow Smart Entrepreneurs Cut Financial Chaos in Half with One Simple Switch

-

Success Advice3 weeks ago

Success Advice3 weeks agoBreaking the Bias: How Females Can Thrive In The Workplace in 2025

-

Scale Your Business3 weeks ago

Scale Your Business3 weeks agoThis Is How Successful Entrepreneurs Manage Their Time Differently

9 Comments