Entrepreneurs

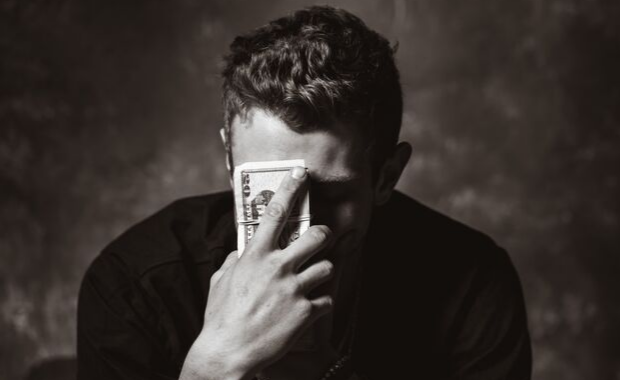

7 Financial Health Strategies for Young Entrepreneurs

Do you know what the main reason is for the failure of newly created companies? The reason is not that they did not conduct a preliminary analysis, did not create a unique proposal, or began to conduct business in a very competitive environment.

The reason many companies fail is due to the issue of not financial monitoring the state of the company. This is especially true for young entrepreneurs when confidence in success, ambition, and adventurism blur common sense.

In this article, we talk about 7 simple yet effective strategies that will allow your company to always remain financially stable:

1. Track Your Performance

This is the main rule of any financial strategy – to know the real price of each of your actions and evaluate it in terms of business profitability. And for this, you will have to work with real numbers, track financial indicators, analyze, and create interim reports.

For example, if you’re the owner of the site participating in an affiliate program, you must accurately understand the cost of each lead attracted to your site and correlate this value with the commission that you receive from the sale. If you launch a contest on Instagram, you must first predict the desired results and understand the cost of each new subscriber from the perspective of the total cost of the prize that you promised them.

2. Optimize and Automate

This is the best way to reduce costs and allocate free money for your development. Modern technologies make it possible for a business to achieve maximum efficiency simply by automating business processes and optimizing labor. Of course, the practical steps will depend on your type of business.

Some examples include transitioning to a remote form of work allowing you to eliminate the need to pay for office rent. Another example is to automate your marketing efforts to save the marketer from routine tasks.

3. Keep Different Accounts for Personal and Business Finances

The best way to create a complete mess in your finances is to not separate personal expenses from business payments. Have you heard of the rule that the owner of a business gets his salary last?

For a business to be sustainable, it is first necessary to pay for the work of employees, make payments on all debts, pay off suppliers, set aside a little non-combustible fund, invest in development, and only then dispose of the remaining money at your own discretion.

“The caliber of your future will be determined by the choices you make today.” – Anthony ONeal

4. Pay Your Obligations on Time

If you want your company to be financially stable, it is important to avoid debts. This applies to all types of payments you need to make within a month. Above, we already listed the main items of expenditure, but the essence of this rule is that by paying everything on time, you will increase the value and profitability of your business. Employees will be loyal to you because they can be sure of tomorrow, suppliers will want to work with you, and loan interests will not grow exponentially.

5. Take Care of Your Employees

Your employees are the main driving force of your business, so they should feel valued. You need to maintain their loyal attitude, because they not only help your company remain financially stable, but also take it to a new level.

Motivated, involved, and confident employees can help you take your business to new heights. As for how to make them such people, just ask a direct question, and they themselves will tell you what they lack in the workplace.

6. Build a Contingency Fund

Of course, clear financial strategies are good, but no one has immunity against sudden changes in your niche. If you use the capabilities of big data and analyze trends, you will be able to see alarm signs before others and have time to adapt. It is crucial to have a contingency fund that will give you the ability to stay afloat until you fully adapt to the changes.

“Someone’s sitting in the shade today because someone planted a tree a long time ago.” – Warren Buffett

7. The Best Way to Spend Is to Invest

If we are just talking about maintaining a business at a certain level of profitability, then in principle, it will be enough to use all of the above tips. But if you want your business to develop, it is necessary to invest in its development. And these investments must be comprehensive.

The best areas to invest in business development are investments in technology, product improvements, and investments in employee education and customer service. Determine for yourself the key areas for business development and you will immediately understand which area requires the most immediate investment.

It is necessary to invest before you take part of the earned money into your pocket. If you don’t, your company could stay stagnant. Additionally, your competitors will not be embarrassed to take advantage of this and derive additional benefits for themselves.

What’s the best piece of financial advice you’ve ever received? Let us know in the comments below!

Entrepreneurs

Why Most Successful Entrepreneurs Feel Like Imposters and How to Fix It

Signs and symptoms of imposter syndrome

Among all the open discourse on mental illness and how it affects different people in their lives, you may have occasionally heard the phrase “Imposter Syndrome” from time to time. (more…)

Entrepreneurs

Smart Business Owners Are Using These Natural Hacks to Outperform the Competition

The smartest companies have figured out that naturopathy in the workplace isn’t just feel-good fluff

Ever sat at your desk thinking, “I seriously can’t handle another day of this”? Does your neck ache because your chair feels more like a torture device than office furniture? Or maybe you’ve been waking up at night panicking about that dreaded meeting again. (more…)

Entrepreneurs

This Scientific Tool Is Reshaping the Way We Make Business Decisions

Organisations that integrate technology intelligently see transformation not just in output, but in thinking

The rules have changed. Technology no longer plays a supporting role, it now drives progress across every industry. From laboratories to boardrooms, innovation has become essential. (more…)

Entrepreneurs

How Workplace Toxins Are Quietly Hurting Employee Performance

Many modern organizations dabble in hazardous substances that can directly impact employee health

Some of us may view sustainability as a buzzword. In the US, environmental risks have become a more legitimate concern than ever. Business leaders cannot afford to sideline them. It doesn’t matter whether your firm is a well-regarded organization or a fledgling startup. (more…)

-

Success Advice4 weeks ago

Success Advice4 weeks agoThe One Mindset Shift That Made Me Irreplaceable At Work

-

Scale Your Business4 weeks ago

Scale Your Business4 weeks agoWhy Smart Entrepreneurs Never Skip This One Business Expense

-

Did You Know3 weeks ago

Did You Know3 weeks ago7 Surprising Life Lessons Video Games Taught Me That School Never Did

-

Success Advice3 weeks ago

Success Advice3 weeks agoHow Playing by the Rules Became the Smartest Business Strategy

-

Success Advice3 weeks ago

Success Advice3 weeks agoHow to Build Trust, Kill Micromanagement, and Lead a Team That Thrives

-

Scale Your Business2 weeks ago

Scale Your Business2 weeks agoHow to Build a Workplace People Actually Want to Show Up To

-

Success Advice2 weeks ago

Success Advice2 weeks agoSuccess Isn’t Sexy: 5 Daily Habits That Actually Work

-

Scale Your Business2 weeks ago

Scale Your Business2 weeks agoHow Smart Entrepreneurs Cut Financial Chaos in Half with One Simple Switch