Entrepreneurs

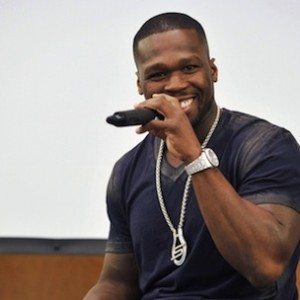

Why 50 Cent Is So Successful

An amazing hunger for more has driven Curtis ‘50 Cent‘ Jackson to leave behind a negative lifestyle to become a multi-platinum selling rapper, an actor and a serial entrepreneur.

50 continues to build his business empire as well as 50 Cent the brand. Building on his success in the music industry 50 continues to branch out into an ever increasing amount of businesses.

50 Cent’s estimated net worth is $140 Million.

50 Cent’s Musical Success

After a difficult childhood, adolescence and an early adulthood consisting of his mother’s death, drug dealing and being shot 9 times 50 Cent turned his attention to his rap career. After being shot, 50 released the mixtape Guess Who’s Back and was consequently discovered by Rapper Eminem who orchestrated the signing of 50 to Shady Records, Aftermath Entertainment and Interscope Records. Eminem teamed up with Dr. Dre to help 50 become one of the best selling rappers in the world with the release of his first album Get Rich or Die Tryin’ . This success was compounded by the success of his subsequent albums and the success of his Hip Hop collective, G-Unit. As well as winning multiple awards 50’s global record sales have exceeded 30 Million.

After a difficult childhood, adolescence and an early adulthood consisting of his mother’s death, drug dealing and being shot 9 times 50 Cent turned his attention to his rap career. After being shot, 50 released the mixtape Guess Who’s Back and was consequently discovered by Rapper Eminem who orchestrated the signing of 50 to Shady Records, Aftermath Entertainment and Interscope Records. Eminem teamed up with Dr. Dre to help 50 become one of the best selling rappers in the world with the release of his first album Get Rich or Die Tryin’ . This success was compounded by the success of his subsequent albums and the success of his Hip Hop collective, G-Unit. As well as winning multiple awards 50’s global record sales have exceeded 30 Million.

50 Cent The Entrepreneur

Successful musicians are no longer with happy with their royalties being their only source of income. 50 Cent has taken the idea of being a multi-talented mogul with a large business empire to the next level.

Successful musicians are no longer with happy with their royalties being their only source of income. 50 Cent has taken the idea of being a multi-talented mogul with a large business empire to the next level.

He has used his popularity and his brand to leverage his talents as a serial entrepreneur. 50 says “once you’re well known there is no time to slow down, you have to market the hell out of yourself and get more exposure.” 50 has made multiple millions of Dollars off the back of his global brand,. From books to vitamin water, 50 has money coming in from a lot of sources.

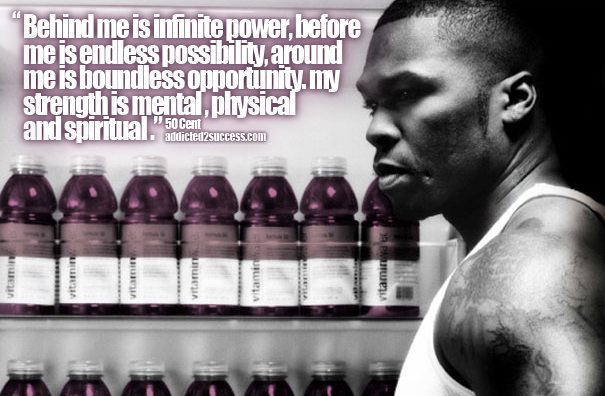

Vitamin Water

One of 50’s most lucrative earners was his deal with Vitamin Water. When he signed a deal to endorse the Formula 50 beverage, the parent company Energy Bands gave him a stake in the business.

In the Spring of 2007 the company was purchased by Coca-Cola with 50’s share of the deal being $100 Million after taxes.

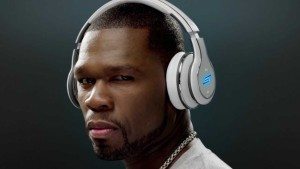

Headphones

In 2011 50 Cent founded the headphones company SMS Audio with SMS standing for Studio Mastered Sound. In the summer of that year 50 purchased KonoAudio for an undisclosed amount.

In 2011 50 Cent founded the headphones company SMS Audio with SMS standing for Studio Mastered Sound. In the summer of that year 50 purchased KonoAudio for an undisclosed amount.

The Headphone business continues to be a growth area for 50 with his company being a pioneer in wireless headphones and recent partnerships with Basketball Star Carmelo Anthony and Intel suggest further growth.

Books

50’s ghost written autobiography From Pieces to Weight reportedly sold somewhere in the region of 100,000 copies with total sales of $1.9 Million.

His latest book, The 50TH Law sees him collaborate with The 48 Laws of Power author, Robert Greene.

“I didn’t go to Harvard but the people that work for me did” – 50 Cent

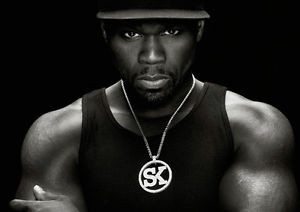

Energy Shots

50 has partnered with Pure Growth Partners to create the flavoured energy drink Street King, now known as SK Energy. The energy drink has had several high profile backers including Floyd Mayweather, Mike Tyson and Joan Rivers leading to an increased profile for the company.

50 has partnered with Pure Growth Partners to create the flavoured energy drink Street King, now known as SK Energy. The energy drink has had several high profile backers including Floyd Mayweather, Mike Tyson and Joan Rivers leading to an increased profile for the company.

50 Cent also uses the profits from every shot purchased to contribute a meal abroad through the World Food Programme.

Clothing

In 2003, 50 joined forces with Mark Ecko Enterprises to create clothes that were to be sold through Ecko Limited. Before parting ways in 2008 G-Unit Clothing was responsible for 15% of Ecko’s revenue. With the clothes and hats bringing in $75 Million in 2006 50’s 8% royalty meant that he made $6 Million that year alone.

The Rest of 50’s Empire

Music, books, vitamin water, headphones, energy drinks and clothing just isn’t enough for 50. Believe it or not, there’s more. 50 cent has acted alongside Al Pacino, Robert De Niro and Forest Whittaker in his developing career as an actor and has even started his own movie production company.

Music, books, vitamin water, headphones, energy drinks and clothing just isn’t enough for 50. Believe it or not, there’s more. 50 cent has acted alongside Al Pacino, Robert De Niro and Forest Whittaker in his developing career as an actor and has even started his own movie production company.

50 has also sold $125 Million+ worth of video games after the title, Bulletproof sold in excess of 2.5 Million Copies. As well as clothes, 50 was paid $20 Million by Reebok in 2003 to design and be the face of a new line of sneakers. The sneakers ended up being a hit, generating more than $320 Million. 50 Cent has made no secret of his desire to be a Billionaire and conducive to this he also continues to build his Real Estate and Financial Portfolios.

“I was born alone and I will die alone. I’ve got to do what’s right for me and not live my life the way anybody else wants it.” – 50 Cent

Philanthropy

With the view of tackling the growing problem in the USA 50 Cent has teamed up with Feeding America through his SMS Audio brand.

With the view of tackling the growing problem in the USA 50 Cent has teamed up with Feeding America through his SMS Audio brand.

50 is committed to helping provide 1 Million million meals to the charity through local food banks in an effort to solve domestic hunger. This was a logical progression from 50’s philanthropic work through his Energy Drink company SK energy where profits help to feed children overseas. 50 has publicly stated that he wants to feed 1 Billion People in Africa.

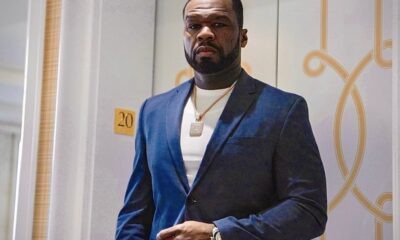

Conclusion

50 Cent teaches us that aggressive business growth and forward thinking decision making can be amazing attributes when becoming a successful entrepreneur. 50 also reminds us that we can gain a lot of motivation and success by giving back what we can when we can.

A person that just seems like a hard, gangster rapper from the outset is actually a lot more. He is an inspiring, caring, driven entrepreneur who will make a real difference whilst he is here or Die Tryin’.

50 Cent Picture Quote

Change Your Mindset

The Silent Skill That Makes People Respect You Instantly

What truly earns respect and why most people go about it the wrong way

Everybody craves respect but not everyone earns it. Some people believe that a title, years of experience, or a position of authority automatically entitles them to respect. (more…)

Entrepreneurs

The Essential Skills Every Entrepreneur Needs In 2026

Success in the digital age isn’t about luck. It’s about mastering the skills that separate dreamers from doers.

When I was 22 years old, I started my first side hustle as a ghostwriter. (more…)

Business

The Hidden Money Pit in Your Operations (and How to Use It)

See how smart asset management software is quietly saving businesses thousands in wasted time, stock, and maintenance.

Trimming unnecessary expenses and minimizing resources is a general practice in running a business effectively. Asset management software can help you achieve those goals. (more…)

Business

Thinking of Buying A Business? These 6 Sectors Quietly Produce the Best Deals

Before you buy your next venture, check out the sectors where successful businesses are changing hands every day.

All entrepreneurs have a desire to be the masters behind a successful venture. Buying an established business is a great choice for many. This provides instant access to an established market with existing infrastructure and clients. (more…)

-

Entrepreneurs4 weeks ago

Entrepreneurs4 weeks agoThe Essential Skills Every Entrepreneur Needs In 2026

-

Change Your Mindset4 weeks ago

Change Your Mindset4 weeks agoHow to Turn Your Mind Into Your Greatest Asset (Instead of Your Enemy)

-

Change Your Mindset3 weeks ago

Change Your Mindset3 weeks agoThe Silent Skill That Makes People Respect You Instantly

-

Life3 weeks ago

Life3 weeks ago10 Research-Backed Steps to Create Real Change This New Year

-

Did You Know2 weeks ago

Did You Know2 weeks agoHow Skilled Migrants Are Building Successful Careers After Moving Countries

-

Tech3 weeks ago

Tech3 weeks agoWhat’s in a Name? How to Get Your Domain Right

3 Comments