Success Advice

The Secret Formula for Real Financial Success

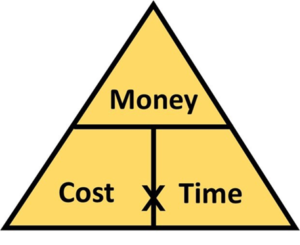

What do you see?

That Money = Cost x Time ?

Or, that Time = Money/Cost ?

Most of us routinely push through the weekdays while we wait for the next weekend to roll around, giving us a moment to choose how we spend and enjoy our time. For those who are merely working to pay the bills, 71% of every week is a total write-off. It’s a sad statistic. What keeps us spending an entire life stuck in this funk?

Naturally, we approach life with the view that money comes first, and at a direct personal trade off, according to this standard work-life formula:

Money = Cost x Time

Whether it’s working extra weekend shifts or moving your way up the company ladder, with more money comes greater personal cost: more energy being drained, more opportunity costs being lost, more obligations to fulfill — in addition to more quality time being given up. Overall, a piece of our life must be sacrificed. But that’s the price we must pay for money, right?

We believe that to be “richer” we need more money. And if we need more money, we must expect to pay a higher cost and trade more of our precious time! What we often seek is a job promotion to raise our income by a few extra dollars a week. Oh… and let’s also raise those overtime hours, weekend call-ins, daily responsibilities, pressures and stresses along with it! More money? Yes. A richer life? Hardly.

Unfortunately, most of us never see otherwise. From our grandparents to our parents to us, this is all we have ever known about the experience of life. Could there be any other way to approach The Money Game?

Money vs Real Financial Success

There is clearly a connection between having more money and potentially gaining more value out of life. But as we all know, a richer life is never defined by money alone. Because what about the cost of money?

All money comes in context, and for every dollar of potential value that we gain there must be some personal cost involved. Obviously, not all money comes at an equal cost. Therefore, real financial success cannot simply be based on being a millionaire or a billionaire.

The millionaire who is stuck working a job he hates for 10 hours a day is clearly less successful that the millionaire who could stop working the job he hated 10 years ago. And, of course, the millionaire who made his fortune doing what he loves really hit life’s jackpot! Same money but all different levels of personal success.

Even if you manage to amass a BILLION dollars to your name, this money has little value if you must spend your entire life trapped in some airtight, corporate box. This big pile of money is little more than a big pile of stress and sacrifices! So, what is financial success, really? It is not defined by the number in your bank account or the car you drive, but ultimately by the effect that money has on the quality of your life.

Forget about the “big bucks” because real wealth and success are simply about experiencing a life with greater positives and fewer negatives. Therefore, money should have one purpose: to add positive value to our lives. So how can we start to view our finances in a way that reflects what we really want in life?

One Formula to Rule Them All

To experience real financial success, our aim for the future is not to simply focus on money, but to instead focus on time. Of course, when it comes to the value of our time, money plays a crucial role. So, what is the connection between money, time and real financial success?

Real financial success is having the money and lifestyle to spend more time doing what you truly want, while spending less time having to fuss and fight over money and be paying all the personal costs that often come with it. Yet, why do so many of us chase money without ever experiencing any greater sense of freedom and satisfaction? Because real financial success is only possible for those with a totally different perspective on life! What is this perspective?

To change our future finances and lifestyle for the better, it starts with taking life’s standard formula: Money = Cost x Time and flipping our natural view. It’s now time to see that: Time = Money/Cost

As you can see, the value of your time is equal to your money divided by your life costs – simply, all the negatives that revolve around getting money. With little money the value of your time clearly suffers. And when earning more money at a much higher personal cost, unfortunately life doesn’t get much better! However, when we approach life with the aim to increase our money AND decrease our cost, what do you get? More valuable time!

Forget about money alone, because the richer you really are, the greater the value of your time. This imbalance between money and cost is the key to experiencing real financial success.

“The rich invest in time. The poor invest in money” – Warren Buffet

Saving Yourself

The “Average Joe” may believe that frugal investors are boring cheapskates who don’t know how to enjoy their money. But what do they often fail to see? As Henry David Thoreau once said: “The price of anything is the amount of life you exchange for it”. The true cost of every purchase is not a number

on a price tag, but rather, a period of time spent working. Some might even say a period of time wasted.

Yes, time is money and money is time. Every expense equals an amount of our life being exchanged…or lost! After considering our endless living costs, taxes and even our unpaid overtime and daily commute, what remains is the real, take-home profit that we can freely use. We call this our “real pay rate”, which for the average earner may only equal a few measly dollars for each hour given up on the job. So what is that lazy, Friday night food delivery really costing you?

The Price of Life

In the wise and misquoted words of Benjamin Franklin: “a dollar saved is a dollar earned”. Every time you save a dollar you earn yourself a dollar (at your real pay rate), literally for doing nothing. And for the smart investor, this saved dollar is just the beginning! Through the nature of passive income and the power of compound growth, every dollar that is saved and invested has the potential to make more money across the future at a low personal cost. Thus, the imbalance of real wealth for the smart investor continues to shift as their money grows.

Consequently, by spending half of your disposable income this week, what you are really spending is half a week of time today and potentially MONTHS of your time in the future! Even small improvements in your daily routine can have a massive impact on your future money and life. By avoiding unnecessary spending you give yourself the opportunity to build more future wealth, and therefore, reduce the amount of your valuable life time that is lost on a routine basis.

Time is Of the Essence

Money is clearly what fuels the journey of life. But is your plan to spend the entire journey stuck at the gas station, refilling your tank? If you’re truly ambitious, life can often feel like a race against the clock. Like you, most frugal investors have a million and one things to tick off their bucket list. And of course, doing paperwork in an office cubicle is not one of them!

Our true aim for the future can only be to maximize the amount of our “life time” that we spend in a way that we consider most personally valuable. So why not fight for your financial freedom? Remember, Time = Money/Cost. The aim of real financial success is to boost the value of your time in life by carefully maximizing your money whilst minimizing your costs. And it takes a natural focus in life towards:

- Making money doing what you truly enjoy

- Creating passive income

Think about the lifestyle of someone who is truly financially successful. They are paid from their passions while their money is making money at little personal cost: thereby giving them much greater satisfaction, freedom and opportunity to gain more value out of life — the total sum of their time! All money has lifelong potential, and those who are on the path to real financial success recognize the value of every dollar…and every day.

This is the secret to real financial success!

Success Advice

The Modern Blueprint for Success: Mastery, Purpose, and High-Income Skills

If your current path feels empty, maybe it’s time to aim for something more meaningful

Success Advice

The 70-Year-Old Management Strategy That’s More Relevant Than Ever

It emphasizes setting clear, measurable goals that align employee efforts with broader company objectives

Every organization has its own vision and mission. But a vision is only as powerful as the people behind it. When employees are actively involved in decision-making and goal-setting, that vision becomes a shared reality. (more…)

Explode Your Social Media

Want More Views? Master These 6 YouTube Growth Tactics

Getting a strong start or feeling stagnant are two completely different problems, but they both need momentum, viewer engagement, and growth to fix them.

Strategic planning combined with unwavering dedication allows you to rise above the chaos of YouTube—luck won’t get you anywhere. (more…)

Change Your Mindset

The Leadership Skill Nobody Talks About (But Changes Everything)

Curiosity often takes a back seat to certainty and gets labeled as a soft skill, which makes it sound obvious and easy

Most of us, when faced with challenges, instinctively seek certainty and answers. In turn, our ego steps in and prompts us to defend our views, double down, or perhaps disengage. (more…)

-

Did You Know4 weeks ago

Did You Know4 weeks ago7 Surprising Life Lessons Video Games Taught Me That School Never Did

-

Success Advice4 weeks ago

Success Advice4 weeks agoHow Playing by the Rules Became the Smartest Business Strategy

-

Success Advice3 weeks ago

Success Advice3 weeks agoHow to Build Trust, Kill Micromanagement, and Lead a Team That Thrives

-

Success Advice3 weeks ago

Success Advice3 weeks agoSuccess Isn’t Sexy: 5 Daily Habits That Actually Work

-

Scale Your Business3 weeks ago

Scale Your Business3 weeks agoHow to Build a Workplace People Actually Want to Show Up To

-

Scale Your Business3 weeks ago

Scale Your Business3 weeks agoHow Smart Entrepreneurs Cut Financial Chaos in Half with One Simple Switch

-

Success Advice3 weeks ago

Success Advice3 weeks agoBreaking the Bias: How Females Can Thrive In The Workplace in 2025

-

Scale Your Business2 weeks ago

Scale Your Business2 weeks agoThis Is How Successful Entrepreneurs Manage Their Time Differently