Entrepreneurs

The Top 10 Dare Devil Entrepreneurs Who Embrace Risk

To become truly great in business, you have to take risks. Risk is also something most people are afraid of and as a result, they shy away from building a successful business in order to avoid it. However, risk taking is also the reason most billionaires came to become some of the richest people on the planet.

Do you consider yourself to be a risk taker? Do you evade or embrace risk as a part of your life?

Well this article will take a look at 10 of the biggest risk takers in business.

Perhaps one day you can borrow a leaf from these dare-devil entrepreneurs and become a major success.

10 Highly Successful Risk Takers In Business

1. Donald Trump

With his monster TV show The Apprentice, a sprawling business empire and a billion dollar fortune, Donald Trump appears to be on top of the world. What you may not know is that it was not always this way. As a matter of fact, there used to be a time when he was facing personal bankruptcy with personal debts of $900 million. Donald Trump’s business also declared bankruptcy with debts of about $3.5 billion.

With his monster TV show The Apprentice, a sprawling business empire and a billion dollar fortune, Donald Trump appears to be on top of the world. What you may not know is that it was not always this way. As a matter of fact, there used to be a time when he was facing personal bankruptcy with personal debts of $900 million. Donald Trump’s business also declared bankruptcy with debts of about $3.5 billion.

However, he had cleared his personal debt within a period of 4 years, greatly reduced his business debt and even merged some of his business interests into a publicly held company, all in a short period of time. Trump is living proof that risk takers can win big in business and lose big as well. As a matter of fact, Trumps success was due to his willingness to take huge risks.

2. Bill Gates

The billionaire Bill Gates took a great amount of risks while founding Microsoft. He had to drop out of college in order to help create Microsoft. He took a huge risk, starting his business based on his vision that the personal computer would be a useful tool in every office and home.

The billionaire Bill Gates took a great amount of risks while founding Microsoft. He had to drop out of college in order to help create Microsoft. He took a huge risk, starting his business based on his vision that the personal computer would be a useful tool in every office and home.

Bill Gates was prepared to travel in the wilderness of the unknown and would do anything to win. He even went up against Steve Jobs and was not threatened to copy or borrow ideas from other great innovators and tech companies. This paid off in the end when his company became a tech giant worth billions of dollars.

3. Henry Ford

The world famous inventor of the automobile was very imaginative and willing to take risks. He slashed prices so steeply that he risked taking losses yet he managed to meet the crushing demand for Model T’s.

The world famous inventor of the automobile was very imaginative and willing to take risks. He slashed prices so steeply that he risked taking losses yet he managed to meet the crushing demand for Model T’s.

In order to satisfy consumer wants, Ford had to take it to the next level with a do or die attitude. Henry Ford even cut down the working hours and increased minimum wages for his workers so that they could work for a longer period of time before quitting. A very risky move that could be considered a mistake to most but was a strong reason why Henry Ford was able to conquer the automobile world.

4. J. Paul Getty

Known for his many failed marriages and his capacity for bearing risk, this billionaire oil baron is one of the most successful business people in our history.

Known for his many failed marriages and his capacity for bearing risk, this billionaire oil baron is one of the most successful business people in our history.

J. Paul Getty founded and controlled Getty Oil Company in addition to 200 other companies. He left some of his wealth to the Getty Foundation which he created while still alive.

5. Larry Ellison

The founder of Oracle and one of the richest people in the world, Larry Ellison’s net worth is somewhere around $50 billion.

The founder of Oracle and one of the richest people in the world, Larry Ellison’s net worth is somewhere around $50 billion.

Much of his success has been attributed to taking huge risks. Larry Ellison would promise people non-existent features, only to go back to his developers and demand them to build the products. He would also hire staff unqualified for their position only to train them later with manuals and books.

6. Richard Branson

The founder of Virgin airways and the 4th richest man in the United Kingdom, Richard Branson’s success has been attributed to taking huge risks in business. With Virgin Records, Branson grew his label by signing controversial acts of the time. He took this risk in order to raise some eyebrows and establish his label in a crowded industry.

The founder of Virgin airways and the 4th richest man in the United Kingdom, Richard Branson’s success has been attributed to taking huge risks in business. With Virgin Records, Branson grew his label by signing controversial acts of the time. He took this risk in order to raise some eyebrows and establish his label in a crowded industry.

At one point, Richard Branson had 125 law suits against his empire, for weird and oddly pathetic reasons. He knows that there are going to be haters out there when you are doing big things, but that doesn’t stop him, he loves the thrill of a risk.

7. Warren Buffett

As an investor, Warren Buffett has never been afraid of taking risks and making mistakes along the way. It is his readiness to take huge risks that have contributed to his astounding success.

As an investor, Warren Buffett has never been afraid of taking risks and making mistakes along the way. It is his readiness to take huge risks that have contributed to his astounding success.

Warren Buffett understands that stocks and shares are a huge game of risks, but he knows the investment of risk taking experience over time minimises his investment risks for the future, and so nowadays he tries his luck investing in various different industries with a huge measure of success.

Right now Warren Buffett is extending out side of investments and branding companies with his Berkshire Hathaway name. Something he has never really done before.

8. Jeff Bezos

Founder and CEO of Amazon.com, Jeff Bezos’ success has been hugely due to the risks he has been taking all throughout his career. Recently, he bought The Washington Post, a struggling new operation and looks to turn it around into a revenue generating business.

Founder and CEO of Amazon.com, Jeff Bezos’ success has been hugely due to the risks he has been taking all throughout his career. Recently, he bought The Washington Post, a struggling new operation and looks to turn it around into a revenue generating business.

Jeff Bezos started his first company from a garage in 1995 and by 1998 he was in charge of a $22.1 Billion market presence.

9. Elon Musk

Elon Musk, co-founded PayPal, he created America’s first viable fully electric car company Tesla Motors, started the nation’s biggest solar energy supplier, and rolled the dice with NASA to launch his space exploration company SpaceX all in the space of 15 short years.

Elon Musk, co-founded PayPal, he created America’s first viable fully electric car company Tesla Motors, started the nation’s biggest solar energy supplier, and rolled the dice with NASA to launch his space exploration company SpaceX all in the space of 15 short years.

Elon has managed to solidify Tesla Motors in a high risk, high cost industry. He faced the critics and haters when he funded his own SpaceX mission to Mars and was on the verge of company collapse when he played Russian Roulette between funding both failing companies Tesla & SpaceX, not knowing if both companies will fall apart or not. Elon Musk is known as this generations well known biggest risk taker.

Elon Musk’s Net-worth is estimated to be $6.4 Billion and growing.

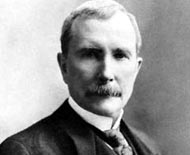

10. John D. Rockefeller

Owning the world’s largest oil supply known as Standard Oil, John D is the wealthiest person that ever lived. A strategic risk taker, John never settled and was always looking for greater things. He would give up good for great and this lead to his huge success. He knew that with the right intentions, anything could be achieved. He was a humble person who left behind a great legacy.

Owning the world’s largest oil supply known as Standard Oil, John D is the wealthiest person that ever lived. A strategic risk taker, John never settled and was always looking for greater things. He would give up good for great and this lead to his huge success. He knew that with the right intentions, anything could be achieved. He was a humble person who left behind a great legacy.

John D. Rockefeller is well known for taking positive calculated risks in every business venture that he got into. So as you can see, taking risks comes with huge success.

The very things that we stand to lose when we take risks are the very same ones that we stand to gain. The dare devil entrepreneurs that are listed above were able to become successful billionaires because they were ready and willing to take risks. If they had stayed in their comfort zones, they probably wouldn’t have made it to the financial heights that they accomplished. In business, great success comes with taking great risks and trusting your instincts that everything will turn out quite right.

You never know what you can accomplish until you do something that you have never attempted.

Taking the risks gives you the opportunity to step into some of the biggest you could ever imagine.

Change Your Mindset

The Silent Skill That Makes People Respect You Instantly

What truly earns respect and why most people go about it the wrong way

Everybody craves respect but not everyone earns it. Some people believe that a title, years of experience, or a position of authority automatically entitles them to respect. (more…)

Entrepreneurs

The Essential Skills Every Entrepreneur Needs In 2026

Success in the digital age isn’t about luck. It’s about mastering the skills that separate dreamers from doers.

When I was 22 years old, I started my first side hustle as a ghostwriter. (more…)

Business

The Hidden Money Pit in Your Operations (and How to Use It)

See how smart asset management software is quietly saving businesses thousands in wasted time, stock, and maintenance.

Trimming unnecessary expenses and minimizing resources is a general practice in running a business effectively. Asset management software can help you achieve those goals. (more…)

Business

Thinking of Buying A Business? These 6 Sectors Quietly Produce the Best Deals

Before you buy your next venture, check out the sectors where successful businesses are changing hands every day.

All entrepreneurs have a desire to be the masters behind a successful venture. Buying an established business is a great choice for many. This provides instant access to an established market with existing infrastructure and clients. (more…)

-

Entrepreneurs4 weeks ago

Entrepreneurs4 weeks agoThe Essential Skills Every Entrepreneur Needs In 2026

-

Change Your Mindset4 weeks ago

Change Your Mindset4 weeks agoHow to Turn Your Mind Into Your Greatest Asset (Instead of Your Enemy)

-

Change Your Mindset3 weeks ago

Change Your Mindset3 weeks agoThe Silent Skill That Makes People Respect You Instantly

-

Life3 weeks ago

Life3 weeks ago10 Research-Backed Steps to Create Real Change This New Year

-

Tech3 weeks ago

Tech3 weeks agoWhat’s in a Name? How to Get Your Domain Right

-

Did You Know2 weeks ago

Did You Know2 weeks agoHow Skilled Migrants Are Building Successful Careers After Moving Countries

10 Comments