Entrepreneurs

Why Peter Jones Is So Successful

The persistence and determination of Peter Jones means that Success was his only option.

Peter Jones estimated net worth is $475 Million.

Peter continues to expand his business empire and his personal brand. He is perhaps best known for his role in the TV Show’s Dragon’s Den and American Inventor.

Peter has earned his hundreds of millions from a diverse range of business interests, starting with making computers and opening a cocktail bar before progressing into mobile phones, media, leisure, property and TV shows.

Jones’ passion for expansion has led him to become an entrepreneur in a wide range of businesses as well a well respected startup investor.

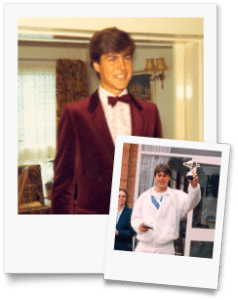

Peter Jones’ First Business

Peter was a visionary from a very young age, he recalls how he would sit in his dad’s office and imagine running a multi-million dollar business. Peter was still a teenager when he realised that he had the talent and skills to be a successful businessman. He combined this business acumen with a love of tennis and spent several summers working at his English Teacher’s summer tennis school. Always keen to learn, Peter wasn’t just working, he was learning. Peter wanted to understand how the business worked and discover how he could do it himself.

Peter was a visionary from a very young age, he recalls how he would sit in his dad’s office and imagine running a multi-million dollar business. Peter was still a teenager when he realised that he had the talent and skills to be a successful businessman. He combined this business acumen with a love of tennis and spent several summers working at his English Teacher’s summer tennis school. Always keen to learn, Peter wasn’t just working, he was learning. Peter wanted to understand how the business worked and discover how he could do it himself.

Peter didn’t stop there, he went on to pass the exams required to be a tennis coach and opened his own tennis school. As far as Peter is concerned, this is where he became an entrepreneur because he was driven by passion under the tutelage of a mentor that he loved.

Peter’s Twenties

After leaving his teens behind, Peter showed no signs of slowing down. He founded a successful computer business which led him to finally start to walk in his vision of a nice house, luxury cars and a large disposable income. However, the business took a turn for the worse and he ended up losing it. After the fall of the computer business, Peter opened a cocktail bar and a computer support business, with the cocktail bar losing him a substantial amount of money.

As his twenties came to close, Peter had no car, money or house so he took a job a in a business that he would end up running in less than a year.

“I passionately believe that you should start a company that you really believe in. Don’t start something that you have no interest in, start something that you’re passionate about.” Peter Jones

Peter’s Business Empire

Phones International Group

(Founded in 1998)

Peter’s next venture after leaving his corporate position was to set up Phones International Group to provide wireless and mobile communications solutions. When the business was in its infancy Peter’s bed was the office floor. However, by the end of the first year revenue had reached $21 million and $65 million by the end of the second year.

Peter’s next venture after leaving his corporate position was to set up Phones International Group to provide wireless and mobile communications solutions. When the business was in its infancy Peter’s bed was the office floor. However, by the end of the first year revenue had reached $21 million and $65 million by the end of the second year.

Peter had founded one of the fastest growing businesses in Europe with a turnover of more than $220 million by 2006.

“Believe in yourself, never give up and go about your business with passion, dive and enthusiasm.” Peter Jones

Red Letter Days

(Purchased in 2005)

In 2005, Jones combined with fellow Dragon’s Den star Theo Paphitis to rescue the company Red Letter Days. Peter’s new company gives experience day vouchers as personal gifts and corporate rewards, ranging from spa days, to racing cars, parachuting and kayaking.

Immediately after taking over the company, Peter and Theo Paphitis decided to honour $25 million of outstanding vouchers to customers.

Jessops

(Purchased in 2013)

After the UK’s legendary photographic retailing giant entered administration in early 2013, Peter Jones stepped in and resurrected the business.

Peter invested several million pounds into the business and has since taken the company from 0 retail stores up to 37 in a very short space of time. Another testament to Peter’s ‘can do’ attitude.

Peter’s Investments

From 2004 onwards Peter Jones founded and invested in many other businesses including Wines4Business.com, Celsius Recruitment, Reggae Reggae Sauce and Concentrate Design which creates products that aid the concentration of children in schools.

Peter on TV

Peter has worked on three major television projects:

1. Dragon’s Den for the BBC which shows entrepreneurs present their business ideas to a panel of ‘Dragons’, one of which is Peter Jones. The entrepreneurs pitch for financial investment for a stake of their company in return.

2. American Inventor which he sold to the American broadcasting company and was co-produced by the Peter Jones Television Company Fremantle and Simon Cowell. The show on which Peter Jones was a judge went on to put ABC ahead of other networks and became a number show in America.

3. Tycoon was produced by the Peter Jones Television Company after Peter signed a deal with UK broadcaster ITV to become the face of business television. The programme where Peter searches for entrepreneurs with ideas that he can turn into profitable companies achieved viewing figures in excess of 2.1 million people.

The Present Day

Peter continues to have many interests across a broad range of businesses that employ over 1,000 people. generating sales upwards of $370 million. As an investor, Peter regularly adds to his ever increasing portfolio of over 40 businesses within the publishing, TV, entertainment, food, new media and product design industries.

Adding to his own, personal interests Peter gives a lot back by focusing on developing Entrepreneurial talent within the UK with a particular focus on allowing young people and young enterprise to thrive under the right guidance.

Conclusion

Everything that a young Peter Jones sat and visualized in his father’s office became his reality. There was nothing that could dampen the resolve of this inspirational entrepreneur. Businesses collapsing couldn’t stop him, expensive cocktail bar investments couldn’t stop him, sleeping on his office floor couldn’t stop him. Nothing can stop Peter Jones, that is what makes him successful.

As Peter Jones continues to give back and develop young, entrepreneurial talent he will continue to take calculated risks and laugh in the face of any adversity.

An incredible man who can teach us all a lot about about the value of self-belief and persistence.

Peter Jones Golden Rules for Success

Entrepreneurs

Why Most Successful Entrepreneurs Feel Like Imposters and How to Fix It

Signs and symptoms of imposter syndrome

Among all the open discourse on mental illness and how it affects different people in their lives, you may have occasionally heard the phrase “Imposter Syndrome” from time to time. (more…)

Entrepreneurs

Smart Business Owners Are Using These Natural Hacks to Outperform the Competition

The smartest companies have figured out that naturopathy in the workplace isn’t just feel-good fluff

Ever sat at your desk thinking, “I seriously can’t handle another day of this”? Does your neck ache because your chair feels more like a torture device than office furniture? Or maybe you’ve been waking up at night panicking about that dreaded meeting again. (more…)

Entrepreneurs

This Scientific Tool Is Reshaping the Way We Make Business Decisions

Organisations that integrate technology intelligently see transformation not just in output, but in thinking

The rules have changed. Technology no longer plays a supporting role, it now drives progress across every industry. From laboratories to boardrooms, innovation has become essential. (more…)

Entrepreneurs

How Workplace Toxins Are Quietly Hurting Employee Performance

Many modern organizations dabble in hazardous substances that can directly impact employee health

Some of us may view sustainability as a buzzword. In the US, environmental risks have become a more legitimate concern than ever. Business leaders cannot afford to sideline them. It doesn’t matter whether your firm is a well-regarded organization or a fledgling startup. (more…)

-

Success Advice4 weeks ago

Success Advice4 weeks agoThe One Mindset Shift That Made Me Irreplaceable At Work

-

Scale Your Business4 weeks ago

Scale Your Business4 weeks agoWhy Smart Entrepreneurs Never Skip This One Business Expense

-

Did You Know3 weeks ago

Did You Know3 weeks ago7 Surprising Life Lessons Video Games Taught Me That School Never Did

-

Success Advice3 weeks ago

Success Advice3 weeks agoHow Playing by the Rules Became the Smartest Business Strategy

-

Success Advice2 weeks ago

Success Advice2 weeks agoHow to Build Trust, Kill Micromanagement, and Lead a Team That Thrives

-

Scale Your Business2 weeks ago

Scale Your Business2 weeks agoHow to Build a Workplace People Actually Want to Show Up To

-

Success Advice2 weeks ago

Success Advice2 weeks agoSuccess Isn’t Sexy: 5 Daily Habits That Actually Work

-

Scale Your Business2 weeks ago

Scale Your Business2 weeks agoHow Smart Entrepreneurs Cut Financial Chaos in Half with One Simple Switch

2 Comments