Success Advice

The Top 7 Reasons Why Youre Losing All That Money

Today we feature a list of “The Top 7 Reasons Why Youre Losing All That Money“. The aim of behavioral finance is to better understand why people make the financial decisions they do. The field of study is becoming widely accepted. In fact, it’s such a crucial part of the Chartered Financial Analyst (CFA) curriculum, a course of study for Wall Street research analysts.

Don’t be intimidated. You might learn something about why you make the financial and investment decision you do.

You think you’re great at investing.

Overconfident investors are often underdiversified and thus more susceptible to volatility.

You think the past is an indicator of the future.

You don’t know how to handle new developments.

You don’t want to book a loss.

You remember your past mistakes.

Your risk tolerance changes with the direction of the market.

You always have good excuses to explain why you were wrong.

Sometimes your investments might go sour. Of course, it’s not your fault, right? Defense mechanismsin the form of excuses are related to overconfidence. Here are some common excuses:

- ‘if-only’: If only that one thing hadn’t happened, then I would’ve been right. Unfortunately, you can’t prove the counter-factual.

- ‘almost right’: But sometimes, being close isn’t good enough.

- ‘it hasn’t happened yet’: Unfortunately, “markets can remain irrational longer than you and I can remain solvent.”

- ‘single predictor’: Just because you were wrong about one thing doesn’t mean you’re going to be wrong about everything else, right?

- ‘dog ate my research’**

**This particular excuse isn’t identified in behavioral finance as far as we know. But we can imagine someone using it.

Business

Why Smart Entrepreneurs Are Quietly Buying Gold and Silver

When stocks, property, and cash move together, smart business owners turn to one asset that plays by different rules.

You’ve built your business from the ground up. You know what it takes to create value, manage risk, and grow wealth. But here’s something that might surprise you: some of the most successful entrepreneurs are quietly adding physical gold and silver to their portfolios. (more…)

Business

The Simple Security Stack Every Online Business Needs

Most small businesses are exposed online without realising it. This simple protection stack keeps costs low and risks lower.

Running a business online brings speed and reach, but it also brings risk. Data moves fast. Payments travel across borders. Teams log in from homes, cafés, and airports. (more…)

Business

If Your Business Internet Keeps Letting You Down, Read This

From smoother operations to better security, dedicated internet access is quietly powering today’s high-performing businesses.

Today, a dependable internet service is the bedrock for uninterrupted business operations. Many organizations rely on stable online connections for communication, data transfer, and customer interaction. (more…)

Did You Know

How Skilled Migrants Are Building Successful Careers After Moving Countries

Behind every successful skilled migrant career is a mix of resilience, strategy, and navigating systems built for locals.

Moving to a new country for work is exciting, but it can also be unnerving. Skilled migrants leave behind familiar systems, networks, and support to pursue better job opportunities and a better future for their families. (more…)

-

News3 weeks ago

News3 weeks agoBrandon Willington Builds 7-Figure Business by Ignoring Almost Everything

-

Health & Fitness3 weeks ago

Health & Fitness3 weeks agoWhat Minimalism Actually Means for Your Wellness Choices

-

Did You Know3 weeks ago

Did You Know3 weeks agoWhy Most Online Courses Fail and How to Fix Them

-

Business3 weeks ago

Business3 weeks agoIf Your Business Internet Keeps Letting You Down, Read This

-

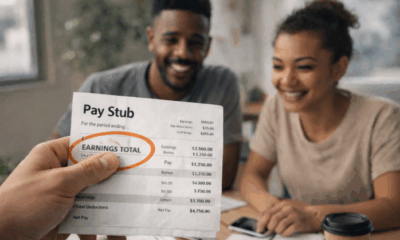

Business2 weeks ago

Business2 weeks agoEntrepreneur’s Guide to Pay Stubs: Why Freelancers and Small Business Owners Need a Smart Generator

-

Business1 week ago

Business1 week agoThe Salary Shift Giving UK Employers An Unexpected Edge

-

Business1 week ago

Business1 week agoThe Simple Security Stack Every Online Business Needs

-

Scale Your Business1 week ago

Scale Your Business1 week ago5 Real Ways to Grow Your User Base Fast