Life

How to Tame the Turbulent Mind in Uncertain Times

Uncertainty. We’ve heard that word a lot in the last few years. However, we have also seen that in nearly every uncertain period, resilience has manifested

Uncertainty. We’ve heard that word a lot in the last few years. However, we have also seen that in nearly every uncertain period, resilience has manifested. Change is a constant part of our day-to-day lives.

Some would argue that it’s the only thing we can accurately predict. In my experience which has spanned more than three decades in wealth management, I have seen market volatility come and go – and it is expected.

The cycles are familiar—the economy expands and contracts and the markets rise and fall, and often our emotions get caught in the waves of change.

According to Schwab, market cycles vary in length. They’ve shared:

“A bull market is a long-term uptrend marked by optimism and a robust economy. By contrast, a bear market is a prolonged downtrend, usually marked by declines of 20% from recent highs, accompanied by widespread negative sentiment. The record bull run in U.S. stocks, which began in early 2009 and ended in March 2020, is a recent example of a long-term market cycle.

Long-term cycles can also include several shorter cycles. For example, within a long-term cycle, there might be short-term sell-offs that didn’t turn into bear markets or periods of largely sideways price movement. As illustrated in the chart below, investors can reference a monthly chart of a benchmark like the S&P 500® index (SPX) for the past 20 years to identify previous long-term market cycles.”

Throughout the years from cycle to cycle, I have said to clients, friends, peers, and beyond – get focused, not emotional. Learning to master your emotions can allow you to become a better investor because instead of making reactive choices, you can make intentional choices.

Here are 10 steps to manage the emotional flair that can occur when change rears its ugly head. These steps can pave the way for sound investment decisions while helping you maintain your overall well-being.

- Understand the Need to Evaluate Your Plan: Revisit your investment strategy based on your goals, risk tolerance, and time horizon. Review the guidelines you have in place for how to react to market fluctuations based on your individual scenario.

- Be On a Need-to-Know Basis: Keep up with market news, but don’t let it dominate your thoughts. Aim for a balanced view by consuming information from reputable sources without getting caught up in sensational headlines. Headlines sell but they are often a lot of hype to get views and clicks.

- Practice Mindfulness: Techniques such as deep breathing, meditation, or yoga can help you stay grounded and manage stress. Mindfulness can help you observe your emotions without letting them dictate your actions.

- Diversification: This can help mitigate risk while opening the doors of opportunity. Diversification can provide a cushion against market volatility that may result in a more stable overall return.

- Focus on Long-Term Goals: Keep your long-term goals in mind to avoid making impulsive decisions based on short-term market movements. Reactive decisions very rarely yield favorable results.

- Respond with Intention and Not Impulse: A knee-jerk reaction often doesn’t consider the whole picture. Instead, assess the situation from a 360-degree perspective, and consider whether any action is necessary based on your strategy.

- Communicate with Your Advisor: Connect with your trusted advisor to get an objective perspective on your investments and ensure that your strategy still aligns with your goals.

- Manage Expectations: Understand that market volatility is normal and that investing involves risk. Set realistic expectations for returns and be prepared for ups and downs. It’s all a part of the process.

- Acknowledge Your Stress and Address it: A healthy lifestyle supports emotional resilience. Taking the time to get in a good workout, ensuring you are getting enough quality sleep, and making nutritious food choices can fuel you during times of heightened stress. Recognizing you are under stress if the first step in preparing to address it effectively.

- Reflect on Past Experiences: Think about how you’ve reacted to past market volatility and whether those reactions were beneficial. Learn from past experiences to improve your response in the future.

We may not be able to control what happens to us in life, but we can always control how we respond to things. The key is to respond – not react. Reacting is an emotional response to a situation that’s often impulsive and can be influenced by our past experiences or fears.

Responding is a thoughtful and deliberate action that involves considering the situation, weighing the options, and making an intentional decision.

By integrating these practices, you can better manage your emotions and make more rational decisions during periods of market volatility.

Did You Know

How Skilled Migrants Are Building Successful Careers After Moving Countries

Behind every successful skilled migrant career is a mix of resilience, strategy, and navigating systems built for locals.

Moving to a new country for work is exciting, but it can also be unnerving. Skilled migrants leave behind familiar systems, networks, and support to pursue better job opportunities and a better future for their families. (more…)

Life

10 Research-Backed Steps to Create Real Change This New Year

This New Year could finally be the one where you break old patterns and create real, lasting change.

Every New Year, we make plans and set goals, but often repeat old patterns. (more…)

Life

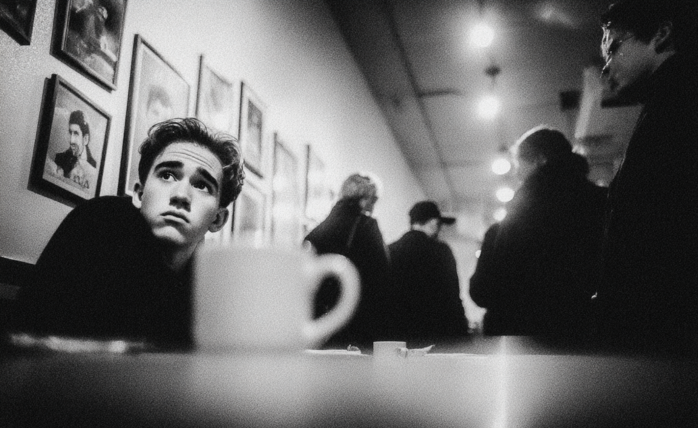

9 Harsh Truths Every Young Man Must Face to Succeed in the Modern World

Before chasing success, every young man needs to face these 9 brutal realities shaping masculinity in the modern world.

Many young men today quietly battle depression, loneliness, and a sense of confusion about who they’re meant to be.

Some blame the lack of deep friendships or romantic relationships. Others feel lost in a digital world that often labels traditional masculinity as “toxic.”

But the truth is this: becoming a man in the modern age takes more than just surviving. It takes resilience, direction, and a willingness to grow even when no one’s watching.

Success doesn’t arrive by accident or luck. It’s built on discipline, sacrifice, and consistency.

Here are 9 harsh truths every young man should know if he wants to thrive, not just survive, in the digital age.

1. Never Use Your Illness as an Excuse

As Dr. Jordan B. Peterson often says, successful people don’t complain; they act.

Your illness, hardship, or struggle shouldn’t define your limits; it should define your motivation. Rest when you must, but always get back up and keep building your dreams. Motivation doesn’t appear magically. It comes after you take action.

Here are five key lessons I’ve learned from Dr. Peterson:

-

Learn to write clearly; clarity of thought makes you dangerous.

-

Read quality literature in your free time.

-

Nurture a strong relationship with your family.

-

Share your ideas publicly; your voice matters.

-

Become a “monster”, powerful, but disciplined enough to control it.

The best leaders and thinkers are grounded. They welcome criticism, adapt quickly, and keep moving forward no matter what.

2. You Can’t Please Everyone And That’s Okay

You don’t need a crowd of people to feel fulfilled. You need a few friends who genuinely accept you for who you are.

If your circle doesn’t bring out your best, it’s okay to walk away. Solitude can be a powerful teacher. It gives you space to understand what you truly want from life. Remember, successful men aren’t people-pleasers; they’re purpose-driven.

3. You Can Control the Process, Not the Outcome

Especially in creative work, writing, business, or content creation, you control effort, not results.

You might publish two articles a day, but you can’t dictate which one will go viral. Focus on mastery, not metrics. Many great writers toiled for years in obscurity before anyone noticed them. Rejection, criticism, and indifference are all part of the path.

The best creators focus on storytelling, not applause.

4. Rejection Is Never Personal

Rejection doesn’t mean you’re unworthy. It simply means your offer, idea, or timing didn’t align.

Every successful person has faced rejection repeatedly. What separates them is persistence and perspective. They see rejection as feedback, not failure. The faster you learn that truth, the faster you’ll grow.

5. Women Value Comfort and Security

Understanding women requires maturity and empathy.

Through books, lectures, and personal growth, I’ve learned that most women desire a man who is grounded, intelligent, confident, emotionally stable, and consistent. Some want humor, others intellect, but nearly all want to feel safe and supported.

Instead of chasing attention, work on self-improvement. Build competence and confidence, and the rest will follow naturally.

6. There’s No Such Thing as Failure, Only Lessons

A powerful lesson from Neuro-Linguistic Programming: failure only exists when you stop trying.

Every mistake brings data. Every setback builds wisdom. The most successful men aren’t fearless. They’ve simply learned to act despite fear.

Be proud of your scars. They’re proof you were brave enough to try.

7. Public Speaking Is an Art Form

Public speaking is one of the most valuable and underrated skills a man can master.

It’s not about perfection; it’s about connection. The best speakers tell stories, inspire confidence, and make people feel seen. They research deeply, speak honestly, and practice relentlessly.

If you can speak well, you can lead, sell, teach, and inspire. Start small, practice at work, in class, or even in front of a mirror, and watch your confidence skyrocket.

8. Teaching Is Leadership in Disguise

Great teachers are not just knowledgeable. They’re brave, compassionate, and disciplined.

Teaching forces you to articulate what you know, and in doing so, you master it at a deeper level. Whether you’re mentoring a peer, leading a team, or sharing insights online, teaching refines your purpose.

Lifelong learners become lifelong leaders.

9. Study Human Nature to Achieve Your Dreams

One of the toughest lessons to accept: most people are self-interested.

That’s not cynicism, it’s human nature. Understanding this helps you navigate relationships, business, and communication more effectively.

Everyone has a darker side, but successful people learn to channel theirs productively into discipline, creativity, and drive.

Psychology isn’t just theory; it’s a toolkit. Learn how people think, act, and decide, and you’ll know how to lead them, influence them, and even understand yourself better.

Final Thoughts

The digital age offers endless opportunities, but only to those who are willing to take responsibility, confront discomfort, and keep improving.

Becoming a man today means embracing the hard truths most avoid.

Because at the end of the day, success isn’t about luck. It’s about who you become when life tests you the most.

Change Your Mindset

The Four Types of Happiness: Which One Are You Living In?

Most people chase success only to find emptiness, this model reveals why true happiness lies somewhere else.

In a world driven by rapid technological growth and constant competition, many people unknowingly trade joy for achievement. (more…)

-

News4 weeks ago

News4 weeks agoBrandon Willington Builds 7-Figure Business by Ignoring Almost Everything

-

Did You Know4 weeks ago

Did You Know4 weeks agoWhy Most Online Courses Fail and How to Fix Them

-

Business3 weeks ago

Business3 weeks agoEntrepreneur’s Guide to Pay Stubs: Why Freelancers and Small Business Owners Need a Smart Generator

-

Business2 weeks ago

Business2 weeks agoThe Salary Shift Giving UK Employers An Unexpected Edge

-

Scale Your Business3 weeks ago

Scale Your Business3 weeks ago5 Real Ways to Grow Your User Base Fast

-

Business3 weeks ago

Business3 weeks agoThe Simple Security Stack Every Online Business Needs

-

Finances3 weeks ago

Finances3 weeks agoWhy Financial Stress Is One of the Biggest Barriers to Personal Growth

-

Business2 weeks ago

Business2 weeks agoWhy Smart FMCG Entrepreneurs Outsource What They Can’t Automate