Entrepreneurs

Why Sean ‘Diddy’ Combs Is So Successful

Sean John Combs, also known as Diddy, P. Diddy and Puff Daddy is the founder and CEO of Bad Boy Worldwide Entertainment Group. The company is a business powerhouse with several streams of income.

Diddy oversees an empire that includes music recording and production, TV, Film, alcoholic beverages, apparel, restaurants and more.

Diddy’s Early Life:

Diddy was born in Harlem and raised in Mount Vernon New York. He first got into the music industry at Uptown records as an intern where he went on to become talent director after dropping out of Howard University. He went on to sign and produce Mary J. Blige.

Diddy was born in Harlem and raised in Mount Vernon New York. He first got into the music industry at Uptown records as an intern where he went on to become talent director after dropping out of Howard University. He went on to sign and produce Mary J. Blige.

In 1994, Diddy founded Bad Boy Records and signed just 2 artists at the time. They were Craig Mack and close friend Notorious B.I.G. The label went on to achieve huge success with these two original artists as well as; Mase, Lil’ Kim, Faith Evans and others.

The Growth of a Music Empire:

Two years later in 1996, Diddy embarked on an incredible 50/50 joint venture with Clive Davis and Arista Records which would allow Bad Boy Records to market their artists to a global marketplace. After an amazing run of success and consistent business growth, Bad Boy Entertainment ended their joint venture on good terms in 2002. Part of deal was for Diddy to retain full control of Bad Boy Records, the artists and the entire back catalogue.

Two years later in 1996, Diddy embarked on an incredible 50/50 joint venture with Clive Davis and Arista Records which would allow Bad Boy Records to market their artists to a global marketplace. After an amazing run of success and consistent business growth, Bad Boy Entertainment ended their joint venture on good terms in 2002. Part of deal was for Diddy to retain full control of Bad Boy Records, the artists and the entire back catalogue.

In the early part of 2003, Diddy and Bad Boy Records announced that they had signed a global distribution deal with Universal Records. The terms of the deal dictated that Universal would provide promotional and marketing services for Bad Boy’s artists and distribute new releases as well as the back catalogue. Crucially, Diddy retained 100% ownership of Bad Boy Records.

Diddy’s estimated net worth is $825 Million.

Clothing Line:

In 1998 Diddy founded Christian Casey LLC, named after his second son. The company designs, produces and distributes urban fashion clothes and accessories for males and females. Christian Casey operates as Sean John Clothing and owned by Bad Boy Entertainment. The Sean John fashion label has been extremely successful with yearly sales in excess of $100 Million. In 2004, the brand was awarded the ‘Men’s designer of the year award by the Council of Fashion Designers of America. Diddy’s Sean John Enterprise also purchased the Enyce clothing line from Liz Claiborne for $20 million in the latter part of 2008.

In 1998 Diddy founded Christian Casey LLC, named after his second son. The company designs, produces and distributes urban fashion clothes and accessories for males and females. Christian Casey operates as Sean John Clothing and owned by Bad Boy Entertainment. The Sean John fashion label has been extremely successful with yearly sales in excess of $100 Million. In 2004, the brand was awarded the ‘Men’s designer of the year award by the Council of Fashion Designers of America. Diddy’s Sean John Enterprise also purchased the Enyce clothing line from Liz Claiborne for $20 million in the latter part of 2008.

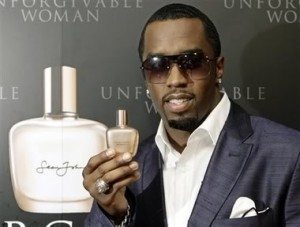

Fragrances:

In a joint venture with Estee Lauder, 2005 saw the birth of Sean John Fragrances. Diddy’s flagship fragrance, Unforgivable, reached Number one in department stores in the USA in a very short space of time. Sean John Fragrances have since expanded to incorporate; Unforgivable Woman and I Am King, which are being sold all over the globe. Unforgivable became the first male fragrance to to claim the title of ‘Best Selling Fragrance’ in 2006 according to a leading retail and consumer information provider. Diddy has twice won ‘Fragrance of the Year’ at Annual FiFi Awards hosted by The Fragrance Foundation, once for Unforgivable and once for I am King.

In a joint venture with Estee Lauder, 2005 saw the birth of Sean John Fragrances. Diddy’s flagship fragrance, Unforgivable, reached Number one in department stores in the USA in a very short space of time. Sean John Fragrances have since expanded to incorporate; Unforgivable Woman and I Am King, which are being sold all over the globe. Unforgivable became the first male fragrance to to claim the title of ‘Best Selling Fragrance’ in 2006 according to a leading retail and consumer information provider. Diddy has twice won ‘Fragrance of the Year’ at Annual FiFi Awards hosted by The Fragrance Foundation, once for Unforgivable and once for I am King.

“If you dream and you believe, you can do it” – Diddy

Alcoholic Beverages:

In an incredible and lucrative move, Diddy entered into a partnership with Diageo to create and manage all marketing processes for Diddy’s brainchild, Ciroc Vodka. The deal dictated that Diddy and Sean Combs Enterprises make all brand related decisions and share future profits and growth with Diageo. This unique collaboration for a USA based spirits company, is set to last several years and will be worth an estimated $100 Million for Diddy.

In an incredible and lucrative move, Diddy entered into a partnership with Diageo to create and manage all marketing processes for Diddy’s brainchild, Ciroc Vodka. The deal dictated that Diddy and Sean Combs Enterprises make all brand related decisions and share future profits and growth with Diageo. This unique collaboration for a USA based spirits company, is set to last several years and will be worth an estimated $100 Million for Diddy.

In the early part of last year, Diddy ignited another partnership with Diageo in order to kick-start a joint venture to purchase DeLeon, a luxury Tequila brand. DeLeon is currently selling for $1000 per in Los Angeles bars. It is currently selling around 10,000 cases per year in only 18 states so Diddy’s famous ability for business growth is destined to take effect for the brand.

“You have to be somewhat crazy, if you want to be successful.” – Diddy

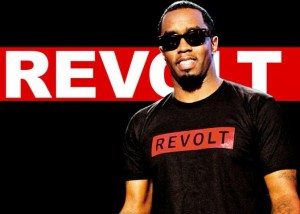

Revolt TV:

In 2013, Diddy was backed by Comcast to launch Revolt TV, a music cable network that is believed to be owned solely by Mr. Combs. In the Spring of last year, Diddy was believed to have bid $200 Million to buy Fuse TV to gain a wider distribution and higher subscriber fees. Although this bid was unsuccessful, it was a clear show of Diddy’s intention to grow the channel and we can expect much more of that in the future.

In 2013, Diddy was backed by Comcast to launch Revolt TV, a music cable network that is believed to be owned solely by Mr. Combs. In the Spring of last year, Diddy was believed to have bid $200 Million to buy Fuse TV to gain a wider distribution and higher subscriber fees. Although this bid was unsuccessful, it was a clear show of Diddy’s intention to grow the channel and we can expect much more of that in the future.

Conclusion:

Diddy is an incredible example of how a persistent, obsession like approach to business growth can create amazing results. It is important to realize that Diddy is one of those ‘self-made’ people that can inspire to believe and take action on our dreams in order to make them a reality.

Diddy’s Success:

Business

Scaling a Business? Here’s What Usually Goes Wrong

Before you hire, expand, or chase bigger revenue, here’s what every founder needs to fix to scale without losing control, culture, or quality.

Growing a business is the dream. But scaling one? Honestly, that is a completely different reality. (more…)

Business

Why Most Financial Plans Fall Apart (And How to Fix It)

Most financial plans fail due to poor risk management, lack of strategy, and emotional decisions – here’s how structured advisory keeps you on track.

Advisory services are redefined into a mandate for individuals and corporates seeking enhanced financial planning capabilities. (more…)

Business

How Business Owners Can Digitally Transform Their Foundation

Business owners managing foundations can use digital systems to automate admin, strengthen donor trust, and scale impact without adding more staff.

Digital transformation affects foundations as organizations just as much. These days, many foundations rely on digital tools for efficient management of their operations. (more…)

Business

How to Evaluate Stocks Like a Pro (Even If You’re Just Starting)

Before you buy your next stock, make sure you understand the 10 essential metrics that reveal whether a company is truly worth your money.

Investing in stocks can be a highly rewarding venture, but it also comes with its challenges. One of the most crucial aspects of successful investing is understanding how to evaluate stocks properly. (more…)

-

Business4 weeks ago

Business4 weeks agoWhy Entrepreneurs Should Care About AI Automation Testing

-

Business4 weeks ago

Business4 weeks agoWhat Every Business Owner Should Know Before Investing in API Integration

-

Business4 weeks ago

Business4 weeks agoWhy Smart Entrepreneurs Are Quietly Buying Gold and Silver

-

Business3 weeks ago

Business3 weeks agoHow Smart Brands Use Instagram Data to Outperform Competitors

-

Business3 weeks ago

Business3 weeks agoThe Paradox of Modern Work: Can Tech Make Us More Human?

-

Change Your Mindset2 weeks ago

Change Your Mindset2 weeks agoThe Hidden Reason You Can’t Stay Consistent

-

Entrepreneurs1 week ago

Entrepreneurs1 week agoThe Six Pillars That Ground Purpose-Driven Leadership (The Berenyi Life Blueprint)

-

Change Your Mindset2 weeks ago

Change Your Mindset2 weeks agoThe Real Psychology Behind Quitting Too Soon

4 Comments