Success Advice

The One Mistake That’s Sabotaging Your Wealth-Building Journey

Relying solely on saving is not enough to attain true wealth

When it comes to financial planning, the conventional wisdom used to be straightforward: save your money.

Traditionally, parents and grandparents would preach the virtues of stashing away every penny, often recalling the difficult times they endured. While they believed that holding onto money would provide the ultimate protection against unforeseen hardships, it is important to recognize that times have changed.

In today’s ever-changing world of finance and economics, relying solely on saving is not enough to attain true wealth.

True wealth necessitates more than mere accumulation; it demands strategic financial manoeuvring. It entails understanding the power of investments, the potential of diversification, and the ability to leverage opportunities when they arise.

It means being aware of the ever-evolving landscape of financial markets and being able to adapt and make informed decisions accordingly.

In this dynamic era, where financial landscapes are constantly shifting, it is vital to broaden our perspective and think beyond conventional saving. By embracing a more expansive and strategic mindset, we can navigate the complexities of today’s financial world and pave the way for long-term financial success and security.

The Changing Face of the Economy

The economy has changed since our parents gave their sage advice. Inflation has become a silent, ever-present force diminishing the value of your hard-earned mo I ney. Increasingly the modest interest rates that are offered by conventional savings accounts, fall short of the average annual inflation rate.

As a result, although your bank balance may grow nominally, your purchasing power is likely to stay the same or even decline.

In our digital age, with all the technological advancements and global economic shifts happening around us, having a passive approach towards wealth accumulation is like trying to win a race while standing still. It just won’t work.

Understanding the Power of Investment

Nowadays, we have sophisticated investment vehicles at our disposal, allowing us to grow our wealth. One of these vehicles is compound interest, famously referred to as the eighth wonder of the world by Einstein.

Unlike simple interest, compound interest has the power to snowball, maximising returns over time and substantially increasing wealth.

Take our client, Sarah, for instance. She began with one commercial property and, with the power of compound interest, expanded her empire into a multi-million dollar portfolio.

This remarkable achievement was not solely by chance; it was a result of well-thought-out decisions, utilising compound interest, and a deep comprehension of the market.

While it’s true that the world of investments comes with pitfalls and risks, some of which can be significant, you can mitigate many potential losses by diversifying your assets and prudently managing risks.

By spreading your investments across different asset classes you can potentially minimise the impact of any single investment’s performance on your overall portfolio.

Additionally, developing a robust risk management strategy can help protect your capital and optimise your investment returns.

With a thoughtful and proactive approach, you can navigate the complexities of the investment landscape more effectively and increase the potential for long-term financial success.

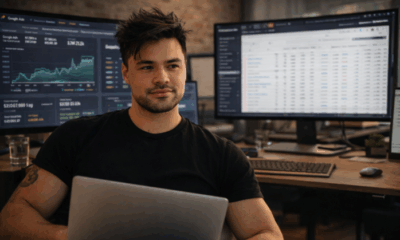

The Golden Goose of Investments

With my extensive experience as a buyer’s agent and investor in the commercial property market, I have had the privilege of uncovering numerous advantages and untapped potential in the dynamic world of commercial real estate.

Not only does this market present excellent investment opportunities, but it also offers a reliable source of rental income. In contrast to residential properties, commercial tenants typically commit to longer leases, offering a heightened sense of stability and consistent returns.

Additionally, the value of commercial real estate tends to appreciate steadily, acting as a formidable buffer against the inherent volatility of traditional market investments such as stocks.

As a result, commercial properties play a pivotal role in a diversified portfolio, providing the much-needed stability and peace of mind that many investors seek.

The Drawbacks of Keeping Cash in the Bank

Storing cash in the bank and regularly checking your bank statement to see a substantial sum can offer a reassuring sense of security. However, historical events have demonstrated that our money may not be as safe as we assume.

During financial crises and recessions, banks can fail, exposing the vulnerability of our funds and leaving us grappling with uncertainty.

Additionally, there’s another hidden disadvantage to solely keeping cash. By not allowing our money to generate more money, every dormant dollar in your bank account represents a potential missed opportunity for earning passive income.

It is crucial to take into account the growth potential that can be realised through exploring alternative investment options. These options can leverage the compounding returns, thereby facilitating the creation of substantial wealth over time.

While seeking security from banks is understandable, it is vital to consider the opportunity cost and explore avenues that enable us to maximise the productivity of our hard-earned money.

Transforming Our Wealth Mindset

The investment landscape can be overwhelming, with countless options, advice, and information to consider, making it challenging to know where to start on the path to financial growth. However, choosing to be paralyzed by these decisions is an expensive choice that can hinder your progress.

Transitioning from saving to true wealth creation requires a profound mindset shift that propels you towards prosperity and long-term financial security.

By expanding your knowledge and exploring new avenues of wealth creation, you can embrace a more comprehensive approach to financial planning.

Additionally, it involves cultivating financial literacy and seeking guidance from professionals who specialise in various aspects of wealth management.

Financial freedom and wealth are not distant dreams; they are tangible realities waiting for those willing to evolve their financial strategies and embrace a proactive approach.

Through my personal experiences, I have witnessed individuals reshape their financial destinies, not solely by luck, but by embracing knowledge, seeking expert guidance, and taking calculated risks.

It’s important to acknowledge that it is not just about collecting wealth; it is about acquiring knowledge and conducting thorough research to make informed financial decisions that shape our economic paths.

Now, more than ever, is the ideal moment to optimise our potential, abandon outdated financial doctrines, and welcome the dynamic realm of wealth creation through strategic investments. With these actions, we can lay the foundation for a secure financial future.

Business

If Your Business Internet Keeps Letting You Down, Read This

From smoother operations to better security, dedicated internet access is quietly powering today’s high-performing businesses.

Today, a dependable internet service is the bedrock for uninterrupted business operations. Many organizations rely on stable online connections for communication, data transfer, and customer interaction. (more…)

Did You Know

How Skilled Migrants Are Building Successful Careers After Moving Countries

Behind every successful skilled migrant career is a mix of resilience, strategy, and navigating systems built for locals.

Moving to a new country for work is exciting, but it can also be unnerving. Skilled migrants leave behind familiar systems, networks, and support to pursue better job opportunities and a better future for their families. (more…)

Life

10 Research-Backed Steps to Create Real Change This New Year

This New Year could finally be the one where you break old patterns and create real, lasting change.

Every New Year, we make plans and set goals, but often repeat old patterns. (more…)

Change Your Mindset

The Silent Skill That Makes People Respect You Instantly

What truly earns respect and why most people go about it the wrong way

Everybody craves respect but not everyone earns it. Some people believe that a title, years of experience, or a position of authority automatically entitles them to respect. (more…)

-

Did You Know4 weeks ago

Did You Know4 weeks agoHow Skilled Migrants Are Building Successful Careers After Moving Countries

-

Health & Fitness5 days ago

Health & Fitness5 days agoWhat Minimalism Actually Means for Your Wellness Choices

-

Did You Know4 days ago

Did You Know4 days agoWhy Most Online Courses Fail and How to Fix Them

-

Business5 days ago

Business5 days agoIf Your Business Internet Keeps Letting You Down, Read This

-

News18 hours ago

News18 hours agoBrandon Willington Builds 7-Figure Business by Ignoring Almost Everything