Success Advice

7 Ways to Make Yourself Better at Managing Your Money

What you know about money management often comes from your experience, advice from your friends, parents, and your wife, or a random search on the Internet. These sources of information are sometimes unreliable and can lead to bad money management skills. In this article, we are going to introduce to you 7 tips on how to manage your money and financial situation effectively and intelligently.

1. Changing the way you think about money

Some people often complicate monetary issues and become stressed about making money, alert to ambition, and feel hatred of material elements while highly appreciate spiritual ones. After all, they often avoid talking about money just because they cannot control it. Saying that they want to give up or they are unconcerned is just a way to hide their pressure and fear when they cannot gain what they want.

To bring your financial situation under control, you have to understand your feelings first. Tana Gildea – the author of “The Graduate’s Guide to Money” – tells you to ask yourself how you feel about money and whether you are good at earning, saving, and managing your money. If you do not feel good, you cannot do it well. Don’t be dependent on money or feel guilty when thinking of it. Instead, believe that you can control your budget and be happy with it.

2. Changing the way you talk about money

People often think that talking about money to others is impolite, so they keep it inside and stress themselves out. Unfortunately, it causes frustration and may lead to many other contradictions. Professor Syble Solomon from the Financial Therapy Association claimed that most couples only talked about money when there was a crisis. Talking about money is challenging but it is a must. Financial clarity is a good way to manage personal finances and create good relationships.

3. Changing the way you spend your money

To live well, try to spend a little below your ability and change your lifestyle to fit your income. This is the key and the most important way to properly manage your money. You should adjust your unreasonable spending to save more money for meaningful goals such as traveling or buying a house. You can also manage your account with the help of a mobile app, a notebook, or a person who is good at money management.

4. Planning your budget

You may equate a budget with strict abstinence, in which you have to sacrifice your comforts and ignore your special pleasures. However, this is not a good way at all, it only makes you a time bomb and you may decide to spend all of your money at once. Instead, you are advised to have a balanced budget, like you are following a balanced diet because money management should be a lifestyle, not an intermediate solution.

5. Spending your money intelligently

Determine whether one thing is important to you or not before spending a sum of money on it. Make sure you have a plan for it and it is one of your priorities. If you want to rent an apartment with a nice view and create a relaxing space at home, it means that you decide to invest your monthly income in living space. If you travel frequently, spend your money on traveling items instead of expensive furniture. Another smart way is to divide your account into two parts, one for your imperative needs and the other for your outbursts. By the way, you will find it easier to manage your finances after doing this.

6. Saving intelligently

Don’t save as much as possible but set your financial goals based on certain contexts to know how much you should save and how long it should take to achieve it. The clearer you define your goals, the more motivation you have to realize them.

“Don’t tell me where your priorities are. Show me where you spend your money and I’ll tell you what they are.” – James W. Frick

7. Saving for retirement

To live well when retiring, you need to save from 15% to 20% of your income (even more than 20% if you can earn a lot of money). Unfortunately, not many people can do so. At first, it may be challenging to save up to 10% or 15% of your income but if this amount of money is subtracted automatically from your salary and transferred into a retirement account, it is much easier.

For instance, with earnings of $50,000/year, you set a goal of saving 10% of it and at the end of each year, you will have $5,000 in your account. But, if you don’t perform this action, what will you do to earn $5,000?

Moreover, this amount of money will bring you profits. With the bank rate of 7%/year, for example, you will have up to $750,000 after 35 years and more than $1 million after 40 years. If you are at the peak of your career and can earn a lot of money, don’t forget to save a part of it for your retirement.

Above, we have introduced to you 7 ways on how to make yourself better at money management. Have you ever tried any of these methods? If yes, please share with us your experience. If no, I hope these methods are useful to you. If you have any questions or comments, you can drop your words below this post. We will respond as soon as possible.

Business

Why Smart Entrepreneurs Are Quietly Buying Gold and Silver

When stocks, property, and cash move together, smart business owners turn to one asset that plays by different rules.

You’ve built your business from the ground up. You know what it takes to create value, manage risk, and grow wealth. But here’s something that might surprise you: some of the most successful entrepreneurs are quietly adding physical gold and silver to their portfolios. (more…)

Business

The Simple Security Stack Every Online Business Needs

Most small businesses are exposed online without realising it. This simple protection stack keeps costs low and risks lower.

Running a business online brings speed and reach, but it also brings risk. Data moves fast. Payments travel across borders. Teams log in from homes, cafés, and airports. (more…)

Business

If Your Business Internet Keeps Letting You Down, Read This

From smoother operations to better security, dedicated internet access is quietly powering today’s high-performing businesses.

Today, a dependable internet service is the bedrock for uninterrupted business operations. Many organizations rely on stable online connections for communication, data transfer, and customer interaction. (more…)

Did You Know

How Skilled Migrants Are Building Successful Careers After Moving Countries

Behind every successful skilled migrant career is a mix of resilience, strategy, and navigating systems built for locals.

Moving to a new country for work is exciting, but it can also be unnerving. Skilled migrants leave behind familiar systems, networks, and support to pursue better job opportunities and a better future for their families. (more…)

-

News3 weeks ago

News3 weeks agoBrandon Willington Builds 7-Figure Business by Ignoring Almost Everything

-

Health & Fitness3 weeks ago

Health & Fitness3 weeks agoWhat Minimalism Actually Means for Your Wellness Choices

-

Did You Know3 weeks ago

Did You Know3 weeks agoWhy Most Online Courses Fail and How to Fix Them

-

Business3 weeks ago

Business3 weeks agoIf Your Business Internet Keeps Letting You Down, Read This

-

Business2 weeks ago

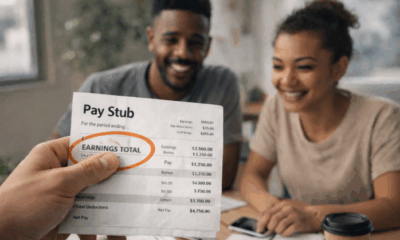

Business2 weeks agoEntrepreneur’s Guide to Pay Stubs: Why Freelancers and Small Business Owners Need a Smart Generator

-

Business1 week ago

Business1 week agoThe Salary Shift Giving UK Employers An Unexpected Edge

-

Business1 week ago

Business1 week agoThe Simple Security Stack Every Online Business Needs

-

Scale Your Business1 week ago

Scale Your Business1 week ago5 Real Ways to Grow Your User Base Fast