Entrepreneurs

A Simple Guide to Unlocking Hidden Profits by Leveraging Business Notes

While loans and investors are common funding sources, business notes are a lesser-known but powerful alternative.

Businesses need cash to run. Whether it’s a new product launch, hiring key people or covering unexpected expenses, access to capital is key. While loans and investors are common funding sources, business notes are a lesser-known but powerful alternative.

These financial instruments allow business owners to fund buyers, structure payment plans and manage liquidity better to unlock hidden profits by leveraging business notes. If structured and sold right a business note can turn future payments into immediate cash, giving businesses the flexibility to grow.

What are Business Notes?

A business note is a legal agreement that outlines repayment terms for a business transaction. Instead of getting full payment upfront, the seller finances the deal and the buyer repays in installments.

These notes are used in business sales, equipment financing and private lending agreements.

For example, a business owner sells their business for $500,000. Instead of the buyer paying the full amount upfront, they structure a deal where the buyer pays $100,000 upfront and the remaining $400,000 over 5 years. The seller holds the business note, earning interest while getting paid over time.

Business notes can include:

- Total amount owed.

- Interest rate and repayment schedule.

- What happens in case of default.

For business owners these agreements provide financial flexibility without having to go to traditional lenders.

Why Business Notes Matter for Startups

An alternative to bank loans

Getting a loan as a startup is no easy feat. Banks require collateral, good credit history and often years of financial records. Many startups don’t meet these requirements. Business notes are an alternative.

Instead of jumping through hoops to get bank funding, entrepreneurs can create private agreements that suit them.

A smart way to sell a business

Selling a business isn’t always a cash-up-front transaction. Many buyers don’t have the funds for an upfront purchase, but that doesn’t mean the deal is off the table.

By structuring the sale with a business note the seller can attract more buyers while still getting paid in instalments. This keeps cash flowing and makes it easier to close deals.

Turn future payments into immediate cash

While holding a business note can provide long-term income there are times when immediate cash is needed. In these cases noteholders can sell their business note to a third party.

Instead of waiting years for scheduled payments they get a lump sum – albeit at a discount – and can re invest or cover pressing expenses.

How to get the best price for your business note

Selling a business note requires planning. To get the best value, business owners need to present their note in the best possible light.

Get all your ducks in a row

Buyers want to see a clear picture of the note’s reliability. A well-documented note includes:

- The original agreement.

- Payment history.

- Buyer’s creditworthiness.

- Collateral for the note.

Choose the Right Buyer

Not all buyers are the same. Some buy business notes, others real estate or consumer debt. Working with a reputable note buyer who knows business transactions means a fair valuation and process.

Time Your Sale for Maximum Value

Selling too soon means lower offers. Early in the loan term most of the payments are interest only. Holding the note until more principal is paid down can increase its value. And monitoring interest rates is key – when rates drop well structured notes become more attractive to investors.

Reinvesting the Proceeds: How Entrepreneurs Use Business Note Sales to Grow

Selling a business note doesn’t just give you cash – it gives you options. Many entrepreneurs have multiple ventures and the proceeds from a note sale can fund the next big idea.

Fund a New Startup

Cash from selling a business note can be used as seed money for a new business. Whether it’s developing a new product, hiring a team or expanding operations, having liquid capital means you can move forward without waiting for slow, incremental payments.

Invest in Marketing and Growth

One of the best ways to use a lump sum is to scale marketing. Digital ads, SEO and content marketing can drive customer acquisition and revenue. Many business owners use the proceeds from a note sale to invest in their brand so they have future cash flow and stability.

Strengthen Financial Security

For entrepreneurs who like to play it safe, using the funds to build an emergency cash reserve can give you peace of mind. Business is unpredictable and having capital on hand can mean the difference between navigating a rough patch and financial disaster.

Conclusion

Business notes give entrepreneurs more than structured payments – they give you flexibility. Whether you’re selling a business, financing a big deal or looking for an alternative to traditional loans, these agreements mean you can control cash flow.

And when it’s time to sell a well prepared note can give you immediate capital so you can reinvest in your next venture or strengthen your financial foundation.

With the right approach business notes can be a game changer for long term success.

Business

Why Smart Entrepreneurs Are Quietly Buying Gold and Silver

When stocks, property, and cash move together, smart business owners turn to one asset that plays by different rules.

You’ve built your business from the ground up. You know what it takes to create value, manage risk, and grow wealth. But here’s something that might surprise you: some of the most successful entrepreneurs are quietly adding physical gold and silver to their portfolios. (more…)

Business

Why Entrepreneurs Should Care About AI Automation Testing

AI automation testing is quietly becoming the unfair advantage behind faster launches, fewer bugs, and startup growth that doesn’t break under pressure.

Faster than ever, the online world pushes entrepreneurs to build sharper tools while moving at full speed. Launching apps, services, or systems? One thing remains clear: fragile code slows everything down. (more…)

Business

Why Smart FMCG Entrepreneurs Outsource What They Can’t Automate

From label mistakes to premium gift sets, manual co-packing gives growing FMCG brands the speed, precision and flexibility in-house teams can’t match.

In the fast-moving consumer goods industry, success isn’t just about having a great product. It’s about speed, efficiency and knowing when to focus your energy on what truly matters. (more…)

Business

The Simple Security Stack Every Online Business Needs

Most small businesses are exposed online without realising it. This simple protection stack keeps costs low and risks lower.

Running a business online brings speed and reach, but it also brings risk. Data moves fast. Payments travel across borders. Teams log in from homes, cafés, and airports. (more…)

-

News2 weeks ago

News2 weeks agoBrandon Willington Builds 7-Figure Business by Ignoring Almost Everything

-

Health & Fitness3 weeks ago

Health & Fitness3 weeks agoWhat Minimalism Actually Means for Your Wellness Choices

-

Did You Know3 weeks ago

Did You Know3 weeks agoWhy Most Online Courses Fail and How to Fix Them

-

Business3 weeks ago

Business3 weeks agoIf Your Business Internet Keeps Letting You Down, Read This

-

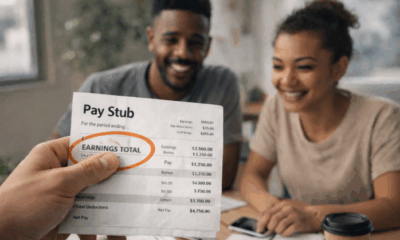

Business1 week ago

Business1 week agoEntrepreneur’s Guide to Pay Stubs: Why Freelancers and Small Business Owners Need a Smart Generator

-

Business1 week ago

Business1 week agoThe Salary Shift Giving UK Employers An Unexpected Edge

-

Business1 week ago

Business1 week agoThe Simple Security Stack Every Online Business Needs

-

Scale Your Business1 week ago

Scale Your Business1 week ago5 Real Ways to Grow Your User Base Fast