Finances

Why Financial Stress Is One of the Biggest Barriers to Personal Growth

Debt, anxiety, and sleepless nights aren’t just money problems, they’re personal growth killers hiding in plain sight.

Broke and stressed? Welcome to the club.

Membership is free because none of us can afford dues.

Debt piles up. Jobs disappear. Expenses keep climbing like they’re training for Everest. The APA found that 72% of Americans struggle with unexpected expenses. That’s basically everyone except lottery winners and trust fund kids.

Money problems wreck more than your bank account. They steal your sleep. They drain your energy. They convince you at 2 am that you’re a failure. Your self-esteem takes hits harder than a boxer’s punching bag.

What is Financial Stress?

Millions of Americans wake up in a cold sweat thinking about bills. It’s not a fun alarm clock. Financial stress doesn’t just empty your wallet. It messes with everything else, too.

Truth be told, it is that uninvited roommate who never leaves. It sits on your couch, eating your snacks while you try to be an adult. But guess what? You can kick it out. There are ways to fight back, calm the anxiety, and take control again.

Financial stress often leads to:

Depression – Constantly coping with money crunches often leads to hopelessness or struggling to focus on making decisions. People dealing with debt are frequently suffering from depression.

Physical ailments – Gastrointestinal issues, headaches, and high BP are some of the common physical ailments that escalate with financial stress.

Social withdrawal – Financial issues are the leading obstacles to personal growth. This causes you to withdraw from social life and lets you clip your wings.

Typical Personal Growth Obstacles Caused by Financial Anxiety

It’s not a mere inconvenience; instead, it’s a major setback that can hinder your long-term growth. Money stress can affect the following areas of personal development:

Skills & education – Without money, you can’t buy self-advancing courses or attend workshops.

Relationships – Exhausted finances often increase stress among the family, minimizing social support, which is crucial for growth.

Career progression – Debt reimbursement can stop you from taking risks, such as starting a side hustle or changing careers.

Motivation – Ongoing financial anxiety can make you feel that small accomplishments feel elusive.

Confidence – Impossible financial obligations can make you question your own capabilities.

Financial stress silently sabotages your long-term objectives, which isn’t about cash issues; it’s about reduced decision-making ability and lost concentration.

If you have been dealing with urgent financial setbacks, several financial wellness tips exist. Money-borrowing options, such as quick, easy, online, no credit check loans with guaranteed approval, can provide relief.

Even though you have bad credit, you can easily get approval for such loans and manage emergency expenses.

Medical bills, routine car maintenance, repairs, and home repairs cause severe money-related anxiety. One method for financial stress management is to create an emergency fund to help stay focused on personal objectives.

You can check out several money borrowing solutions to tackle financial obligations. This type of emergency financial support offers instant solutions to your financial problems, letting you continue your personal growth courses without having to leave them midstream.

Financial Wellness Tips & Tricks to Consider

Managing unexpected expenses isn’t a hassle if you go through these financial wellness tips below:

1. Set a realistic budget – Build a solid, realistic budget that includes all expenses and savings goals, including money allocated for personal development courses.

2. Facilitate savings – Set aside a small amount every time after your salary to reduce future financial burden.

3. Consider debt reimbursement – Focusing on high-interest debts and managing smaller balances is a way to achieve stress-free finances.

4. Use advanced borrowing options – An online inquiry for no-credit-check loans can provide you with instant relief.

5. Hinder impulse shopping – Emotional purchases often take a toll on your finances. Therefore, always plan to avoid regret later.

Why Do You Need Debt Solutions and Advanced Borrowing Strategies for Personal Growth?

Without knowing debt management and advanced borrowing techniques, money-related anxiety may gradually decrease your decision-making capabilities.

Below are the reasons why they are essential for personal growth:

Optimize decision-making – You can make more informed choices about education and career growth when debt is lower.

Allow long-term planning – With advanced borrowing techniques and methodical debt-repayment plans, you can allocate funds for investments and personal growth.

There are also a few reasons to be well-acquainted with streamlined borrowing strategies and top-notch debt solutions; they help:

- Regain mental clarity

- Boost financial confidence

- Minimize emotional burden, etc.

What Will You Achieve by Budgeting?

Budgeting for personal development ensures ongoing self-improvement. By allocating the smallest portion of your income, you can:

Create an emergency fund – Save money for unforeseen expenses.

Invest money in personal development – Buy online courses, books, and more.

Save money for health & wellness – It covers all types of preventive care and fitness classes.

Optimize financial confidence – Small savings every month can help build money management habits.

Make you ready for future goals – It enables you to set aside money for education, vacations, or personal projects.

Conclusion

It’s essential to be financially healthy for personal growth, as financial stress is often a hindrance to it.

If you’re dealing with persistent money problems and unmanaged debt, seeking professional help is required for mental clarity. Otherwise, it can silently drain your focus and motivation.

Finances

From Debt to Financial Independence: A Practical Roadmap Anyone Can Follow

It’s about having control over your money and not letting money control you.

The 21st century has brought incredible opportunities but also new challenges. Rapid technological change, global uncertainty, and shifting lifestyles have made many people think more deeply about financial freedom. (more…)

Finances

How to Manage Your Finances Better During the Holiday Season

Planning ahead will be essential for anyone looking to stay on top of their finances this holiday season.

Holiday spending is predicted to increase this year, with 30% of consumers intending to spend more in 2021 than they did in 2020. (more…)

-

Health & Fitness2 weeks ago

Health & Fitness2 weeks agoWhat Minimalism Actually Means for Your Wellness Choices

-

News1 week ago

News1 week agoBrandon Willington Builds 7-Figure Business by Ignoring Almost Everything

-

Did You Know2 weeks ago

Did You Know2 weeks agoWhy Most Online Courses Fail and How to Fix Them

-

Business2 weeks ago

Business2 weeks agoIf Your Business Internet Keeps Letting You Down, Read This

-

Business2 days ago

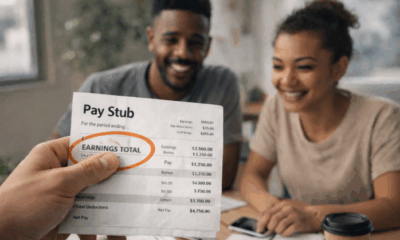

Business2 days agoEntrepreneur’s Guide to Pay Stubs: Why Freelancers and Small Business Owners Need a Smart Generator

-

Business3 hours ago

Business3 hours agoThe Simple Security Stack Every Online Business Needs