News

The Top 10 Millionaires & Billionaires Who Lost It All

As the famous saying goes, “The brightest flame burns the quickest“. There are plenty of successful entrepreneurs who quickly rise to financial success, only to lose everything just as abruptly.

Life in the fast lane is not without its speed bumps, and here are some of the people who went from rags to riches – and then vice-versa.

The Millionaires & Billionaires Who Lost It All

1. Jordan Belfort

The once was Multi-Millionaire stockbroker had it all. Yachts, planes, women, midget throwing parties & drugs where just a few of the high life activities on Jordans agenda. Jordan was reported to be making $250 Million at the age of 25 through his stockbroking firm Stratton Oakmont which functioned like a boiler room and later served as inspiration for the creation of the film also known as ‘Boiler Room‘, starring Vin Diesel & Giovanni Ribisi. Jordan Belfort’s multi millions where stripped from him when the FBI pinned him for securities fraud and money laundering.

After Jordan Belforts release from jail and paying back the 100 millions of dollars he owed other stock brokers Jordan decided to turn his life around releasing the New York Best Seller ‘Catching The Wolf Of Wall Street‘ which was written by Jordan himself about his Wall Street sagas and his run ins with the law. This Book has been developed into a movie which will be directed by Martin Scorsese starring Leonardo DiCaprio as Jordan Belfort. Jordan also has toured the world discussing how to achieve success without sacrificing integrity and ethics.

The lesson here is that there is always room for change, if Jordan can change his life for the good, you can too.

2. Kim Dotcom

This German internet millionaire is most popularly known as the founder of Megaupload, an online file sharing service. Kim Dotcom’s fall from grace isn’t really because of bad business decisions as much as he was involved in a lot of suspected criminal activities. While his website is being accused of copyright infringement, he’s also been charged with insider trading, embezzlement, and computer fraud. The problem with Kim is not only that he couldn’t handle his rock star lifestyle, but also the fact that he amassed his fortune through suspected illegal means.

UPDATE: Kim Dotcom has returned with a more legit way of sharing with his new online company MEGA. We will keep you updated with his progress. Good on you Kim for having another go and doing things right.

3. Allen Stanford

Currently in jail and awaiting trial, this former billionaire was charged with running a multi-billion dollar Ponzi Scheme. Having acted as the Chairman of Stanford Financial Group, he’s been accused of masterminding a financial conspiracy to rob investors out of their hard-earned money and misused their funds to sustain his extravagant lifestyle. Like Kim Dotcom, he tried living the good life at the expense of others and is now reaping the consequences of his actions. As of today, Allen Stanford is taking a number of medications for his depression and is even partially blind after an inmate assaulted him.

4. M.C. Hammer

MC Hammer rose to fame in the 1990s and earned around $30 Million during the peak of his musical career. Shortly after his success, M.C. Hammer wasted no time squandering his fortune on mansions, sharing money with friends and expensive toys. Before the decade was over, he filed for bankruptcy due to an enormous debt. He’s a classic example of someone earning his wealth too fast and too soon, which made it hard for him to handle his finances. Now living as a pastor in California, he learned the hard way that one should learn from their mistakes and consider the consequences of a decision before making it.

5. Sean Quinn

Only a few years ago, this Irish businessman was worth $6 Billion. However, he quickly lost it all after he invested twenty five percent (25%) in Anglo Irish Bank. However, his mistake was to use money he borrowed from his own insurance company. When a financial crisis swept his country, his Anglo Irish shares suffered and caused him billions in debt. What people can learn from Sean Quinn’s example is that itís alright to take risks only if youíve done your homework to avoid getting burned after taking the plunge.

6. Patricia Kluge

She’s the wife of the late John Kluge who was worth billions himself during the late 90s. Following their divorce in 1990, Patricia Kluge began to market a 960-acre vineyard that was supposed to appeal to an ultra-rich clientele. She loaned close to $70 million just to put up facilities, but eventually the real estate crisis in the late 2000s caused her venture to fail and the property foreclosed. The lesson to remember here is that successful entrepreneurs shouldnít put all their eggs in one basket. Otherwise, you can easily lose everything in one swift stroke.

7. Bjorgolfur Gudmundsson

Hailing from Iceland, this former billionaire saw his net worth dwindle down to zero after he and his son/business partner Thor got hit by the credit crisis in their country. They were major shareholders in a bank called Landsbankiñ when it went under, so did their assets. Like some of the others on this list, Bjorgolfur Gudmundsson too was involved in illegal activities such as fraud and embezzlement in the past.Karma is b!tch, aint it!

8. George Foreman

This heavyweight champion became riddled with financial woes when his boxing career lost steam in the late 70s. Naturally, the money stopped coming in and he became overwhelmed with credit card debt and unpaid loans. Fortunately for George Foreman, he bounced back from his situation by getting back in the ring as well as investing in the popular TV shopping product called the Foreman Grill.

9. Johnny Unitas

This legendary quarterback earned hundreds of thousands of dollars at a time because of his unmatched prowess on the field. He starred in professional football before salaries were measured in millions. His yearly contracts ranged from $7,000, his first in 1956 with the Colts, to $250,000 plus a $175,000 bonus in his last one with the San Diego Chargers in 1973. Johnny Unitas put his money into the different industries he dabbled in, such as real estate, restaurants, and manufacturing. Unfortunately, these businesses failed and they were forced to file for bankruptcy by the 90s. He died 11 years later with a lawsuit from his estate hanging over all of his businesses.

10. Scott Eyre

Scott Eyre was a former pitcher for the MLB and played for likes of the Toronto Blue Jays and Chicago Cubs. He was one of Allen Stanford’s victims who invested in his fraudulent billion-dollar scheme which cost Scott almost all of his money. As such, he is proof that we shouldn’t invest in something until we’ve thoroughly assessed the risks as well as the person or entity behind it. Steve Jobs once said that perfectly normal folks can turn into ‘bizarro people’ when they suddenly come upon wealth.

Indeed, losing control and common sense is one of the biggest risks that successful entrepreneurs face. Rich people are human and therefore just as fallible as everyone else. If you don’t want to share the same fate as them, make sure to exercise financial intelligence by either learning about it yourself or consulting with someone who can help you use sound judgment. Just because you have piles of cash, it doesn’t automatically mean you already know how to handle it properly. Don’t fall prey to materialism. Money is fleeting, and you may not be able to afford the finer things in life if you take a hit tomorrow. This is why you should always make a conscious effort to live within your means and hold off buying something until you’ve thought it through.

Article By Joel Brown | Addicted2Success.com

News

The Top 21 Richest Celebrity Couples In The World

This years list of the worlds richest celebrity couples is pretty impressive. With a collective net worth of $4.1 Billion between these 21 cashed up couples there is more than enough money for them to buy a few Ambani skyscraper homes and all move in together. (more…)

News

Think & Grow Rich: The Legacy Film

We have some incredible news for you. For the first time in history, the Napoleon Hill Foundation has granted exclusive rights to Think Rich Films to transform the book, Think and Grow Rich, into a motion picture film, one that will impact another 100 million lives worldwide.

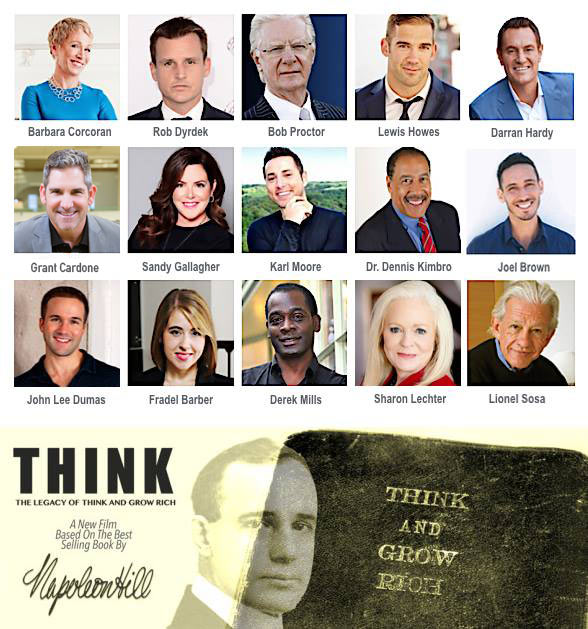

I am excited to announce that I will be featuring in this film alongside Bob Proctor, Lewis Howes, Rob Dyrdek, Barbara Corcoran, Grant Cardone, Darren Hardy, John Lee Dumas and many more incredible thought leaders.

Here’s the new teaser trailer for the film:

As true fans of Think and Grow Rich, we worked for over 3 years, pouring our hearts and souls into creating a film that is a pure representation of the Legacy of this life changing literary masterpiece.

Our guiding light along the way was to remain true to the content and in doing so spark the flame that will ignite a global movement with a powerful message.

The message is that anyone can succeed irrespective of their circumstances. Human potential is not predicated by age, race, gender, education, finance or any other perceived disadvantages.

Join us in Los Angeles on October 14, 2017 for the historical World Premier of Think and Grow Rich: The Legacy a film based on Napoleon Hill’s best selling book, Think and Grow Rich.

Join Us For The Premiere

Saturday October 14, 2017 at Regal L.A. LIVE: A Barco Innovation Center

Location: 1000 W Olympic Blvd, Los Angeles CA 90015

Red Carpet: 5:30pm – 6:00pm

Film Kick Off with Producers & Director: 6:20pm – 6:30pm

Film Showing: 6:30pm – 8:00pm

Q & A with Cast: 8:00pm – 8:30pm

PLUS… a panel discussion with the cast hosted by Gerard Adams

Attire: Formal/Semi Formal

VIP Private After Party Katsuya at L.A. LIVE: 9:00pm to Midnight

This exclusive VIP event following the Premiere will be private to cast members, producers, director and key individuals who made this film possible.

Hors d’oeuvres & Beverages will be provided and hosted by Katsuya.

Click the button above and scroll to the bottom of the next page to get your General or VIP tickets

The heartbeat of Think and Grow Rich: The Legacy

A glimpse of what you will see..

A glimpse of what you will see.. “Faith is going to give you the ability to continue through the highs and lows…” – Rob Dyrdek

“I remember being 24, new in business and being stopped dead reading the book…” – Barbara Corcoran

“Follow your dreams! Whether you achieve them or not is irrelevant…” – Lewis Howes

Click the button above and scroll to the bottom of the next page to get your General or VIP tickets

News

The Top 10 Highest Paid Music Artists In The World

Forbes has just put out the list for highest paid musicians for 2015.

These music artists have created some very catchy yet inspiring songs this year. Music is the one thing that creates an “escape” for most people. It can inspire you, make you happy, pick you up when you’re down, etc. (more…)

News

The Top 50 Highest Paid Celebrities of 2015

Forbes ranked the most successful celebrities of 2015! The list is quite stunning!

From movie actors and actresses to pro athletes, this list has definitely brought together some of the most inspirational people in the entertainment world today. (more…)

-

Success Advice4 weeks ago

Success Advice4 weeks agoAn Easy to Follow 8 Step Strategy for Creative Problem Solving

-

Entrepreneurs4 weeks ago

Entrepreneurs4 weeks agoCrisis-Proof Your Business Now: Essential Strategies for Every Entrepreneur

-

Success Advice3 weeks ago

Success Advice3 weeks ago10 Landing Page Hacks Experts Are Using to Generate Leads

-

Entrepreneurs3 weeks ago

Entrepreneurs3 weeks agoThe Mindset Shifts Required to Become a Successful Online Entrepreneur

-

Success Advice2 weeks ago

Success Advice2 weeks agoThe Power of Ethical Leadership: How Integrity Drives Success

-

Entrepreneurs2 weeks ago

Entrepreneurs2 weeks ago6 Hacks to Boost Your Productivity as a Business Owner

-

Success Advice1 week ago

Success Advice1 week agoHow to Choose the Best Affiliate Programs for Your Blog

-

Entrepreneurs2 weeks ago

Entrepreneurs2 weeks ago5 Important Legal Tips Every Entrepreneur Should Know

25 Comments